Join Executive Chairman, Richard Williams, CEO Sam Ash, and CFO & Corporate Secretary, Gerbrand Van Heerden for a live virtual event as they provide Bunker Hill Mining's strategic vision for 2024, along with a recap of the financial and operational groundwork laid in 2023, setting the stage for the anticipated production restart later this year.

The event will be on Monday, January 8th at 2 pm ET / 11 am PT and you can join by registering at this link.

2023 ACCOMPLISHMENTS

- Corporate:

- Upsized and improved $67 million financing package provided by Sprott Private Resource Streaming & Royalty LLC

- Uplisted to TSX-V

- ESG Developer/Explorer of the year awarded at the ‘Resourcing Tomorrow’ investment conference

- Mining:

- Russell Portal dimensions enlarged to enable underground (“UG”) mechanized mining rates of 1800-2500tpd

- Wardner Operating Yard, adjacent to the Russell Portal and the hub for UG mining operations, connected to electrical power grid

- Wardner Yard footprint increased via redistribution of waste from Russell Portal upgrade

- Processing

- Bunker Hill Operating Yard prepared for start of construction of new processing plant

- Final Process Plant engineering 95% complete

- Tailings Facility and Paste Backfill Plant advanced in partnership with Tierra Group & Ausenco

- Offtake and Marketing

- Finalized the Zn offtake with Teck’s Trail smelter in Northern BC

- People:

- Site team augmented with recruitment of Maintenance Planner, Chief Geologist & Site Controller

- New CFO, Gerbrand Van Heerden started in the role in November

NEXT STEPS

- Upgrade of UG ventilation, ramp access, power, and construction of UG Maintenance Shop

- Geotechnical stabilization work for Process Plant foundations and final construction to commence

- Finalize Tailings Filtration and Paste Plant engineering, procurement and construction

- Finalize the Pb offtake with Teck – January 2024

- Enhance the strength of the operating team

- Refine elements within the balance sheet to reduce overall cost of restart capital

- Refine value-creating optionality, including the Bunker Hill 2.0 (2500tpd) concept

TORONTO, Jan 5, 2024 – Bunker Hill Mining Corp. (the “Company”) (TSXV: BNKR) (OTCQB: BHILL) is pleased to provide a recap on corporate and project activities during 2023, whilst unlocking future equity upside for all stakeholders.

Sam Ash, CEO, said: “The execution of our Bunker 1.0 (1800tpd) restart project remains on time and budget; and is testament to the leadership and skill of the team. 2024 is shaping up to be an exciting year as we advance the project through constructing and into production.”

CORPORATE

On June 26, 2023, Bunker Hill announced the closing of an upsized and improved $67 million financing package with Sprott Private Resource Streaming & Royalty Corp. (“Sprott Streaming”), including the $46 million multi-metals stream (the “Stream”) and $21 million debt facility (the “Debt Facility” and, together with the Stream, the “Financing Package”). This financing is expected to fully fund the project for restart.

Building on the successful refinancing efforts, Bunker Hill announced the receipt of final listing approval from the Listing Committee of the TSX Venture Exchange (the “TSX-V”). The common stock of the Company (the “Common Shares”) began trading on the TSX-V on September 8, 2023, under the symbol “BNKR”. The Company’s Common Shares were delisted from the Canadian Stock Exchange (the “CSE Delisting”) at the close of business on September 7, 2023.

On December 14, 2023, Bunker Hill was awarded the ESG Developer/Explorer of the Year Award at Mines and Money’s ‘Resourcing Tomorrow’ Investment Conference in London on 30 Nov 2023. The award not only recognizes the careful, thoughtful and imaginative work done by the whole Bunker Hill Team but also the responsibility that is bestowed on all involved in the business of regenerating old mine sites to help de-risk the American critical metals supply chain.

A FIT FOR PURPOSE BASE FOR MINING OPERATIONS

During the course of 2023, the Wardner Operating Yard, the base for Bunker Hill’s future mining operations, underwent a significant transformation. This included the removal of the old, prefabricated concrete (10’ x 10’) portal and its replacement with upsized steel arch sets (16’ x 16’) supported with bespoke lagging. This enlarged Russell Portal supports the planned 1800tpd operation with significant additional upside capacity and allows easy access/egress for the mine and its fleet of 20ton+ trucks and 4-6yd Loaders. Whilst this work was underway, executed by GMS Mine Repair & Maintenance based out of Maryland, the Bunker Hill team also completed procurement of a new 300hp Beckwith & Kuffel compressor and a 7ft 400hp mainline fan (and starter), both of which will be installed before the end of the year.

Additional activity in support of mining operations during this period included: the refurbishment of multiple electrical transformers by Industrial Support Service LLC; rehabilitation of the surface warehouse and workshop at Wardner; the rehabilitation and insertion of ladders into a 100ft section of the Cherry Raise that ensures the mine will have not one but two secondary escapeways (or a tertiary escapeway option) when in operation; and a substantial increase in yard laydown area due to the tactical dumping of waste from the portal work.

Initial earthwork in support of portal.

First set of steel sets being positioned.

Spreaders inserted prior to burying steel sets.

CONNECTION TO MAINLINE POWER

In parallel with the portal upgrade, Bunker Hill partnered with Avista Utilities and Wilson Construction Co. and connected the Wardner footprint with mainline power. This involves equipping the site with 1.85MW of electricity, generated through the hydroelectric-dominated supply of the Pacific Northwest, at rates of below 6c per kwh as the operation gets underway and below 5c per kwh as cumulative electrical usage ramps up and the operation falls into the highest-usage category. This is a significant milestone for Bunker Hill’s operating cost base and for the first time gets the site away from exclusive reliance on diesel generators at Wardner.

Figure 1: Avista Utilities working to install upgraded power from the nearby substation up Division Street in Wardner and to site.

Figure 2: Wilson Construction Co. installing overhead powerlines on Bunker Hill property.

Figure 3: Overhead power installation complete at Wardner.

PROCESSING AND TAILINGS FACILITIES

Engineering of the main Process Plant is advancing on track with deep pier establishment scheduled to commence in the next month as part of geotechnical stabilization and preparation of the land for the construction of the Process Plant itself. All main civil, structural and mechanical outputs were on track to be at IFC before year end. Long-lead procurement has resulted in purchase orders having already been issued for the Pre-Engineered Metal Building (PEMB), ore silo, conveyors, Ball Mill starter motor, thickeners tanks and inching drive. Refurbishment of the Pend Oreille mill equipment, the source of the majority of mill components, was well underway at year end.

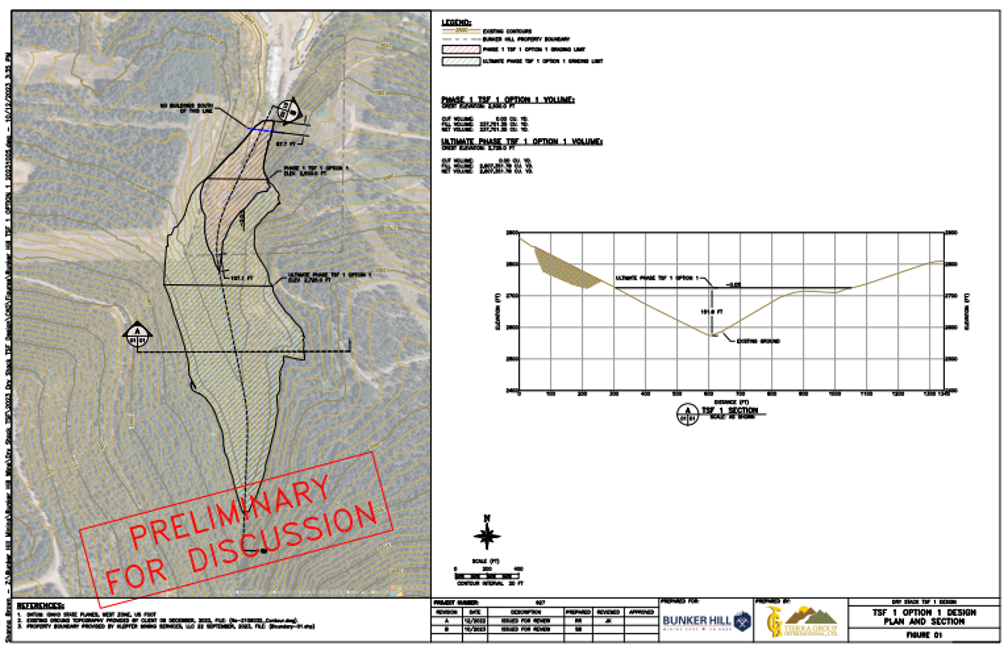

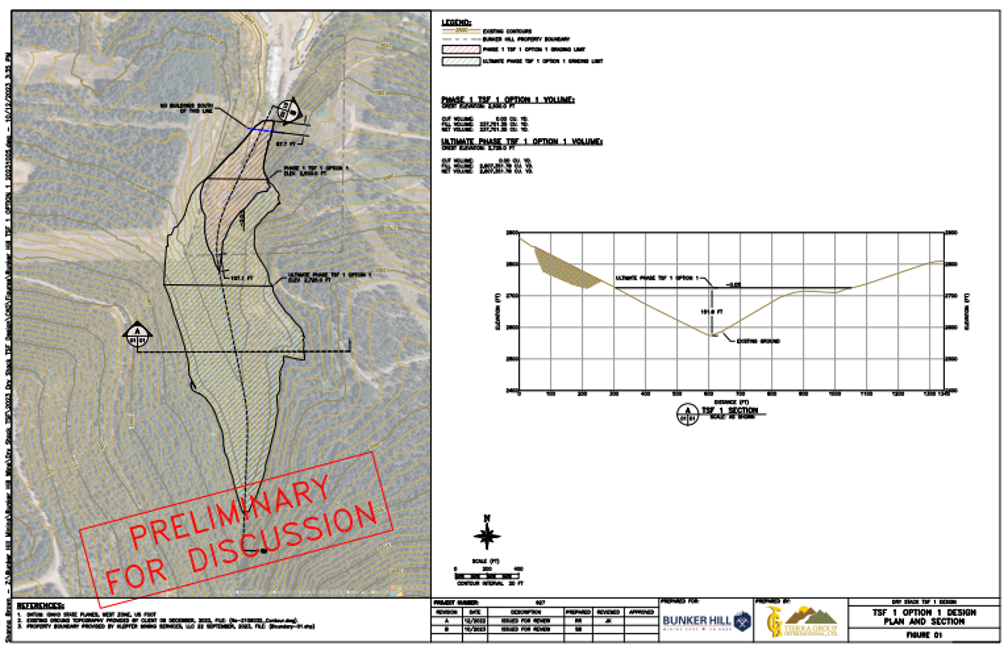

The Bunker Hill team hosted an onsite visit by Ausenco, responsible for the design and engineering of the Filtration Plant and Paste Plant during October. This visit identified the potential for some pre-existing structures in Wardner to be repurposed to help house the Paste Plant. Tierra Group International, which is leading on the Dry Stack design and engineering, the second part of Bunker Hill’s dual tailings solution, issued preliminary designs for a Life of Mine facility on the Bunker Hill footprint. Further geotechnical work in support of these designs were completed during the last quarter of the year.

Preliminary Dry Stack Tailings Storge Facility designs for Bunker Hill

RECRUITING

The team continued a careful upwards recruiting trajectory and onboarded a Maintenance Planner, Chief Geologist and Site Controller. Additional Mine Engineering personnel are coming on board in early 2024. Further to a previous Management Update (14 August 2023), the new CFO, Gerbrand van Heerden, started at the beginning of November.

14 Oct - Newly completed and enlarged Russell Portal

QUALIFIED PERSON

Mr. Scott E. Wilson, CPG, President of RDA and a consultant to the Company, is an independent “qualified person” as defined by NI 43-101 and is acting as the qualified person for the Company. He has reviewed and approved the technical information summarized in this news release.

The Qualified Person has verified the information disclosed herein, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

ABOUT BUNKER HILL MINING CORP.

Under new Idaho-based leadership, Bunker Hill Mining Corp. intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating a portfolio of North American mining assets with a focus on silver. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

For additional information contact:

Corporate Secretary

+1 208 370 3665

ir@bunkerhillmining.com

Cautionary Statements

The TSXV has neither approved nor disapproved the contents of this news release.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts

responsibility for the adequacy or accuracy of this release.

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations (collectively, “forward-looking statements”). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan” or variations of such words and phrases. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking statements could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements.

Forward-looking statements in this news release include, but are not limited to: the Company’s intentions regarding its objectives, goals or future plans and statements, including the timing and budget of the planned restart of the Bunker Hill Mine, including the required project funding in connection therewith; estimations of the supply of power to the Russell Portal and the benefits of same; the benefits of the Wardner Yard upgrades; the expected budget and estimated completion time and benefits of the UG upgrades, processing and tailing facilities, and operating yard, including further geotechnical, design and engineering work in support thereof; the procurement of purchase orders and the timing for and installation of operational equipment; the recruitment of additional personnel; revenue potential opportunities from mining and the sale of ore; increases in cash flow; and the Company’s seeking other value-creating opportunities. Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to the Company’s inability to raise sufficient capital for its operations; the fluctuating price of commodities, capital market conditions, restriction on labour and international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine, including the possibility of further required financings, and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision, including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company's cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine Complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR+ and EDGAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this news release have been disclosed in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The terms “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the CIM standards. Pursuant to subpart 1300 of Regulation S-K (“S-K 1300”), the U.S. Securities and Exchange Commission (the “SEC”) now recognizes estimates of “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources.” In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be substantially similar to the corresponding standards of the CIM. Investors are cautioned that while terms are substantially similar to CIM standards, there are differences in the definitions and standards under S-K 1300 and the CIM standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven reserves,” “probable reserves,” “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources” under NI 43-101 will be the same as the reserve or resource estimates prepared under the standards adopted under S-K 1300. Investors are also cautioned that while the SEC now recognizes “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources,” investors should not assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Mineralization described using these terms has a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “measured mineral resource,” “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, information concerning mineral deposits contained in this news release may not be comparable with information made public by companies that report in accordance with U.S. standards.