News Releases

Bunker Hill Announces 3.8 Meters at 997 Ag Eq g/t Drill Intercept, Ten Channel Samples Above 900 Ag Eq g/t Including 0.6 Meters at 3,003 Ag Eq

Bunker Hill to Host a Webinar on Wednesday, March 31 @ 8:00am PT/11:00am ET

HIGHLIGHTS:

- Ten separate high-grade silver mineralization results greater than 900 g/t AgEq 1 , each with minimum 0.6m length, identified through targeted chip-channel sampling in newly accessible part of 9-level Deadwood vein

- Best selected chip sample includes 0.6m at 1,100 g/t Ag and 60% Pb, representing 3,002.6 g/t AgEq 1

- Mineralization remains open up dip, down dip and along strike from the sampling location

- Follow-up diamond drilling is planned to test the extent of the Deadwood vein and nearby Jersey vein

- High-grade silver, lead and zinc mineralization, including 3.8m at 197 g/t Ag, 21.2% Pb and 2.7% Zn, representing 996.6 g/t AgEq 1 , intersected at down-dip extension of the UTZ zone at the 5-level

- Executive Chairman Richard Williams, CEO Sam Ash, and CFO David Wiens to host live interactive 6ix virtual investor event on Wednesday, March 31st at 11:00AM ET / 8:00AM PT to discuss these results, ongoing silver exploration and other near-term catalysts. Investors are invited to register for this event at: LINK

TORONTO, March 29, 2021 (GLOBE NEWSWIRE) -- Bunker Hill Mining Corp. (CSE: BNKR) (“Bunker Hill” or the “Company”) is pleased to report multiple high-grade silver mineralization results as part of its ongoing silver-focused drilling program, and through chip-channel sampling of newly accessible areas of the Bunker Hill Mine identified through the Company’s proprietary 3D digitization program.

Sam Ash, CEO of Bunker Hill, stated: “Having completed the drilling campaign designed to support the mine restart plan and associated PEA, we have now shifted our drilling and sampling focus to high-grade silver exploration in order to bring more silver into our upper mine resources and future mine planning.

Today’s results confirm high grade silver mineralization in two distinct areas of the upper mine close to existing infrastructure. Firstly, we have confirmed the silver potential of the Deadwood vein through ten separate high-grade channel samples. Secondly, our systematic targeting methodology allowed us to confirm the presence of high-grade silver mineralization on the 5-level through drilling, within an area where no historical mining was conducted. Both of these areas, along with others, will be followed up and developed over the coming weeks.”

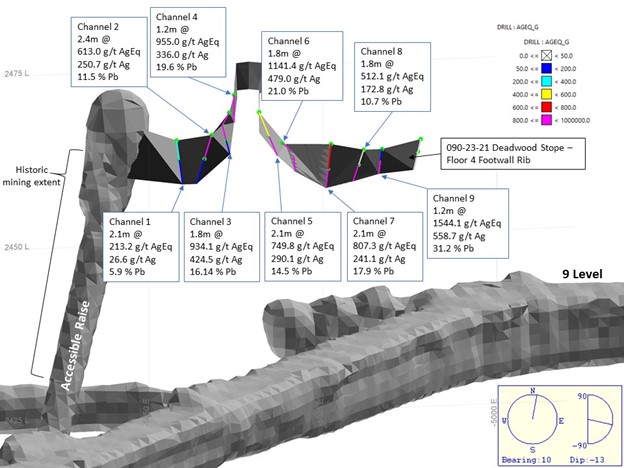

Channel Sampling at the 9-Level Results in Ten Separate High-Grade Silver Mineralization Results

As a result of the digitization of the historic mine data and underground reconnaissance, an area was identified on the 9-level with access to the Deadwood vein: a shallow dipping galena-quartz (“GQ”) silver-lead vein that was mined until mine closure. The vein is exposed in the footwall rib of an historic stope over roughly 35 feet horizontally, with the thickness of mineralized exposure ranging from roughly 1 to 2 meters. Chip samples were collected from 10 vertical channels on the footwall rib designed to approximately crosscut the strike of the vein. See Figure 1 showing the sample distribution and resulting grades.

Digitization and reconnaissance efforts indicate that silver-lead mineralization from the Deadwood vein remains open to testing up-dip, down dip and along strike to the west. Follow up diamond drilling is planned to test the extent of the Deadwood vein and nearby Jersey vein, another historically mined GQ silver-lead vein on the 9 Level of the mine.

______________________________

1 Prices used to calculate Ag Eq are as follows: Zn=$1.16/lb; Pb=$0.92/lb; and Ag=$20/oz.

Figure 1: 090-23-21 Deadwood Vein Stope – Floor 4 Footwall Rib Channel Samples

https://www.globenewswire.com/NewsRoom/AttachmentNg/6e30b1cd-59c5-4713-95c4-84a9328e8c8a

Channel sample assays results are presented in the Table 1 below.

TABLE 1: CHANNEL SAMPLE ASSAYS

| Channel | From | To | M | AgEq g/t | g/t Ag | %Pb | %Zn | |

| 1 | 0 | 0.9 | 0.9 | 317.5 | 56.8 | 8.2 | 0 | |

| 0.9 | 2.1 | 1.2 | 135.1 | 4 | 4.1 | 0 | ||

| Channel | From | To | M | AgEq g/t | g/t Ag | %Pb | %Zn | |

| 2 | 0 | 1.2 | 1.2 | 1156.7 | 497 | 20.9 | 0 | |

| 1.2 | 2.4 | 1.2 | 69.4 | 4.4 | 2.1 | 0 | ||

| Channel | From | To | M | AgEq g/t | g/t Ag | %Pb | %Zn | |

| 3 | 0 | 0.6 | 0.6 | 1022.2 | 312 | 22.5 | 0 | |

| 0.6 | 1.2 | 0.6 | 1618.9 | 940 | 21.5 | 0 | ||

| 1.2 | 1.8 | 0.6 | 161.2 | 21.6 | 4.4 | 0 | ||

| Channel | From | To | M | AgEq g/t | g/t Ag | %Pb | %Zn | |

| 4 | 0 | 1.2 | 1.2 | 955 | 336 | 19.6 | 0 | |

| Channel | From | To | M | AgEq g/t | g/t Ag | %Pb | %Zn | |

| 5 | 0 | 1.2 | 1.2 | 412.4 | 96 | 10 | 0 | |

| 1.2 | 2.1 | 0.9 | 1199.6 | 549 | 20.6 | 0 | ||

| Channel | From | To | M | AgEq g/t | g/t Ag | %Pb | %Zn | |

| 6 | 0 | 0.9 | 0.9 | 1228.7 | 581 | 20.5 | 0 | |

| 0.9 | 1.8 | 0.9 | 1054.2 | 377 | 21.4 | 0.1 | ||

| Channel | From | To | M | AgEq g/t | g/t Ag | %Pb | %Zn | |

| 7 | 0 | 1.2 | 1.2 | 737 | 206 | 16.8 | 0 | |

| 1.2 | 2.1 | 0.9 | 901 | 288 | 19.4 | 0 | ||

| Channel | From | To | M | AgEq g/t | g/t Ag | %Pb | %Zn | |

| 8 | 0 | 0.9 | 0.9 | 49.2 | 2.5 | 1.4 | 0.1 | |

| 0.9 | 1.8 | 0.9 | 975.1 | 343 | 20 | 0 | ||

| Channel | From | To | M | AgEq g/t | g/t Ag | %Pb | %Zn | |

| 9 | 0 | 0.6 | 0.6 | 85.7 | 17.3 | 2.2 | 0 | |

| 0.6 | 1.2 | 0.6 | 3002.6 | 1100 | 60.3 | 0 | ||

| Channel | From | To | M | AgEq g/t | g/t Ag | %Pb | %Zn | |

| 10 | 0 | 0.6 | 0.6 | 21.3 | 2.6 | 0.6 | 0 | |

| 0.6 | 1.5 | 0.9 | 40.1 | 20.3 | 0.6 | 0 |

(Reported widths are actual sampled interval lengths and do not state the true width of the mineralized structure. Samples were taken in a manner to reflect, as closely as possible, true structural width. Prices used to calculate AgEq are as follows: Zn=$1.16/lb; Pb=$0.92/lb; and Ag=$20/oz.)

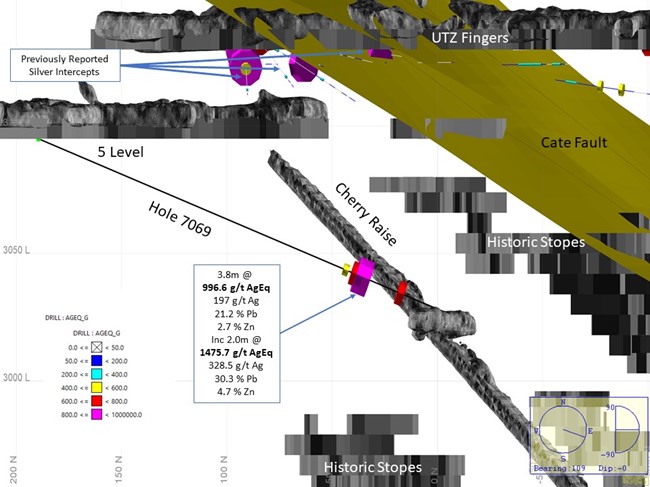

Drilling at the 5-Level Results in Nearly 4-Meter Intercept at Approximately 1,000 g/t AgEq

Concurrently, drilling from the 5-level UTZ intersected high-grade silver-lead-zinc mineralization below the UTZ fingers zone, as part of exploring for near-surface silver targets. The Company is excited to report a 3.8m intercept with a grade of 996.6 g/t AgEq, as indicated in Table 2 below. Intercepted mineralization in hole 7069 (see Figure 2 below showing cross-section and Figure 3 below showing drill core) lies near existing rehabilitated infrastructure, providing low-cost access to the zone for mining under Bunker Hill’s Phase 1 program of the Rapid Restart Plan. Follow up drilling will explore the extent of the mineralization and increase the understanding of the geology in the area.

The drill results in the table below represent the most recent assay data available since the Company’s news release dated February 26, 2021; the Company will continue to report mineralized drill intercepts concurrent with its ongoing exploration program that is currently envisaged to comprise 10,000 to 12,000 feet in 2021.

TABLE 2: HIGH-GRADE SILVER INTERCEPT FROM HOLE 7069

| 7069 | From | To | M | AgEq | g/t Ag | %Pb | %Zn |

| 44.5 | 48.3 | 3.8 | 996.6 | 197 | 21.2 | 2.7 | |

| Including | 45.7 | 46.3 | 0.6 | 706.5 | 164 | 15.3 | 1.5 |

| 46.3 | 47.2 | 0.9 | 1491.7 | 350 | 28.6 | 5.9 | |

| 47.2 | 48.3 | 1.1 | 1462.0 | 310 | 31.8 | 3.7 |

| 7069 | From | To | M | AgEq | g/t Ag | %Pb | %Zn |

| 52.4 | 53.3 | 0.9 | 755.3 | 160 | 15.9 | 2.3 |

(Reported widths are intercepted ore lengths and not true widths, as relationships with intercepted structures and contacts vary. Prices used to calculate AgEq are as follows: Zn=$1.16/lb, Pb=$0.92/lb, Ag=$20/oz.)

Figure 2: Cross section of hole 7069

https://www.globenewswire.com/NewsRoom/AttachmentNg/11b3bb0c-606c-478d-ab42-22e391a9ecb8

Figure 3: Drill Core from hole 7069

https://www.globenewswire.com/NewsRoom/AttachmentNg/057e8c21-a292-4690-aef4-4209f48e9b08

The preliminary economic assessment (“PEA”), aimed at assessing the mine’s rapid restart potential, remains on track to be published in early Q2 2021.

WEBINAR

Bunker Hill will host a webinar to discuss the Company’s recent results and future exploration plans. The webinar will take place on Wednesday, March 31 at 8:00 am PT/11:00am EST. Management will be available to answer questions following the presentation.

To join the webinar, register from this link (also includes dial-in instructions):

Link: https://6ix.com/event/high-grade-silver-mineralization-results-what-does-this-mean-and-whats-next/

UPCOMING EVENTS

Adelaide Capital Idaho Conference

April 8, 2021 @ 12:00pm ET – 4:00pm ET

Join Us: REGISTER NOW

World Gold Forum

April 13-15, 2021

https://www.worldgoldforum.com/

HC Wainwright Mining Conference

April 19-20, 2021

Join Us: REGISTER NOW

121 Mining Investment Americas

April 27-29, 2021

https://www.weare121.com/121mininginvestment-new-york/

TECHNICAL INFORMATION

Chip-channel samples were collected by hand using hammer and chisel perpendicularly across exposed mineralized structures to best represent the true width and nature of the material present. Sample collar locations were surveyed using modern survey techniques to provide positioning of each sample in three-dimensional space. Bunker Hill followed standard quality assurance/quality control (“QA/QC”) practices to ensure the integrity of samples through collection, preparation and delivery of samples to the lab. All sample locations have been photographed, with channel traces spray painted to indicate the location and orientation of each sample. Standards of certified reference materials, field duplicates and blanks were inserted as samples shipped with the chip samples to the lab.

The diamond drilling program used HQ-size core. Bunker Hill followed standard QA/QC practices to ensure the integrity of the core and sample preparation through delivery of the samples to the assay lab. The drill core was stored in a secure facility, photographed, logged, split into halves and sampled based on lithologic and mineralogical interpretations. Standards of certified reference materials, field duplicates and blanks were inserted as samples shipped with the core samples to the lab.

American Analytical Services (“AAS”) was used to provide analytical services and all results comply with both National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and industry standards. AAS holds an industry standard ISO 17025:2005 accreditation, specifying general requirements for laboratory performance. AAS is independent from Bunker Hill.

QUALIFIED PERSON

Mr. Scott E. Wilson, CPG, President of Resource Development Associates Inc. and a consultant to the Company, is an independent qualified person as defined by NI 43-101 and is acting as the qualified person for the Company. He has reviewed and approved the technical information summarized in this news release.

ABOUT BUNKER HILL MINING CORP.

Under new Idaho-based leadership, Bunker Hill Mining Corp. intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating a portfolio of North American precious-metal assets with a focus on silver. Information about the Company is available on its website, www.bunkerhillmining.com, or under the Company’s profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

For additional information contact:

Sam Ash, President and Chief Executive Officer

+1 208 786 6999

sa@bunkerhillmining.com

CAUTIONARY STATEMENTS

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations. Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by terminology such as “may”, “will”, “could”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “projects”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not historical facts.

Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. The key risks and uncertainties include, but are not limited to: local and global political and economic conditions; governmental and regulatory requirements and actions by governmental authorities, including changes in government policy, government ownership requirements, changes in environmental, tax and other laws or regulations and the interpretation thereof; developments with respect to the coronavirus disease 2019 (“COVID-19”) pandemic, including the duration, severity and scope of the pandemic and potential impacts on mining operations; and other risk factors detailed from time to time in the Company’s reports filed on SEDAR and EDGAR.

Forward-looking information and statements in this news release include statements concerning, among other things: the Company’s intention to conduct follow up drilling to test the extent of the Deadwood vein and nearby Jersey vein; the Company’s intention to conduct follow up drilling from the 5-level of the mine to explore the extent of the mineralization and increase the understanding of the geology in the area; the timing for publishing the PEA aimed at assessing the mine’s rapid restart potential; and the Company’s intentions regarding its objectives, goals or future plans and statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: the ability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labor and international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine Complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR and EDGAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.