News Releases

Bunker Hill Announces Completion of Geophysics Survey; Enters Into US$2,500,000 Bridge Loan Financing

TORONTO, Sept. 23, 2021 (GLOBE NEWSWIRE) -- Bunker Hill Mining Corp. (the “Company”) (CSE: BNKR, OTCQB: BHLL) is pleased to announce completion of the field portion of its ground geophysical survey previously announced on June 16, 2021. The focus of the program now turns to data compilation and analysis, with results to be released in the coming weeks.

Concurrently, the Company is also pleased to announce that it has entered into an agreement for a loan of US$2,500,000 to support near-term working capital requirements.

Sam Ash, CEO of Bunker Hill Mining, stated: “Our exploration team was tasked to identify new mineralization near to both the surface and existing infrastructure. The completion of this geophysics survey is an important step in their on-going campaign, and we look forward to reporting its findings and next steps. We are also pleased to have secured bridge financing to support our working capital requirements as we complete our project finance process.”

GEOPHYSICS SURVEY COMPLETION

The program began on July 21st and ended with the final line survey being completed on Sept 20 th . In total, 23 lines were surveyed covering over 1,200 acres across the southwestern portion of the Bunker Hill land package. All of the field data has been acquired and sent off for QAQC and inversion. Preliminary results show a high level of data integrity, well-defined lithologic distinctions, and multiple major faults that cross the survey area.

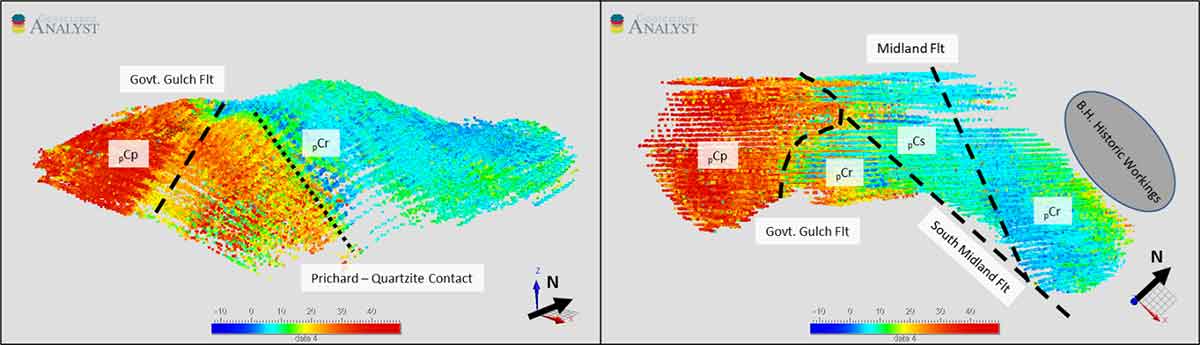

Preliminary chargeability data in Figure 1 below shows the clear lithologic distinction between the Prichard Formation argillites (high chargeability – illustrated in red/yellow) and quartzites from the Revett and St. Regis Formations (low chargeability – illustrated in blue/green) found in the survey area. The areas of low chargeability are of particular interest given that mineralization at the Bunker Hill Mine is typically hosted within quartzites and siltites of Revett and St. Regis formations.

Figure 1. Left: Oblique view showing preliminary chargeability data response between the Prichard formation argillites and the quartzites of the Revett formation, lithologic host for the majority of historic production at Bunker Hill. The Government Gulch fault can also be seen by the large drag structure in the upper levels of the quartzites. Right: Plan view showing additional fault structures and different lithologies including the mixed quartzites and argillites of the St. Regis formation. The Midland fault complex has similar offset and associated rock sequences to those of the Buckeye fault within the Bunker Hill historic footprint, which is associated with known mineralization.

Once analysis is complete, the Company will use the data to identify potential near-surface drill targets that could complement production and delineation drilling related to the rapid restart of the Bunker Hill Mine. Given the proximity of major fault structures and lithologic sequences to areas of historic production, results could indicate the potential for follow up drilling from existing workings underground.

Finalized data from the geophysics survey is expected by the beginning of November 2021.

BRIDGE LOAN FINANCING

The Company has entered into an agreement for a loan of US$2,500,000 (the “Loan”), with a maturity date of the earlier of March 15, 2022, or the date at which more than US$10,000,000 of equity in the Company is raised in aggregate, beginning September 22, 2021.

The Loan will be used for working capital purposes while the Company continues to pursue longer-term, non-dilutive financing opportunities as part of its ongoing project finance process. The Company has no immediate plans to pursue an equity financing.

The Loan will also be used to purchase a land parcel contiguous to the Bunker Hill Mine (the “Land”) for approximately US$200,000. The Land will be available as security for the Loan.

Interest on the outstanding principal balance shall accrue daily and be calculated, in arrears, at the rate of 15% per annum and payable at maturity. There are no other fees or costs payable in relation to the Loan, which may also be repaid at any time prior to maturity without penalty.

QUALIFIED PERSON

Mr. Scott E. Wilson, CPG, President of Resource Development Associates Inc. and a consultant to the Company, is an Independent “Qualified Person” as defined by NI 43-101 and is acting at the Qualified Person for the Company. He has reviewed and approved the technical information summarized in this news release.

UPCOMING EVENTS

StockPulse Silver Symposium

September 27-28, 2021

Join Us: REGISTER NOW

ABOUT BUNKER HILL MINING CORP.

Under new Idaho-based leadership the Bunker Hill Mining Corp, intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating a portfolio of North American precious-metal assets with a focus on silver. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR and EDGAR databases.

For additional information contact: ir@bunkerhillmining.com

CAUTIONARY STATEMENTS

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations. Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company’s intentions regarding its objectives, goals or future plans and statements, the Company’s ability to restart and develop the Bunker Hill Mine, the Company’s ability to purchase the Land, the Land’s use as security for the Loan, the finalization of the data from the geophysics survey, the utility of the data from the geophysics survey to identify potential near-surface drill targets, the ability for the Company to secure longer-term, non-dilutive financing. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: the ability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine Complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.