HIGHLIGHTS:

- The in-progress resource conversion drill campaign totaling 8,000 feet (2,440 metres) is on track for completion to be completed by year-end

- Polymetallic zinc, lead, and silver mineralization has been intersected in all 14 diamond drill holes completed to date, the results of which will be used to convert Inferred mineralization to a higher confidence category supporting an updated resource and reserve statement in Q1|25

- A bonanza-grade exploration target with the potential to add several million ounces of high-grade silver resource has been identified adjacent to existing workings on the 8 level, and a second drill program to commence in Q1|25

KELLOGG, IDAHO | VANCOUVER, BRITISH COLUMBIA — October 22, 2024 — Bunker Hill Mining Corp. (“Bunker Hill” or the “Company”) (TSXV:BNKR|OTCQX:BHLL) is pleased to report that in-mine exploration is continuing to delineate targets designed to support higher run-of-mine grade as we move towards production in H1|25.

The 8,000-foot (~2,440 metres) definition drill campaign was initiated in May this year with the goal of converting inferred mineralization into higher-confidence categories and increasing reserves and mine life. A second drill campaign, totaling approximately 3,000 feet (~910 metres), will commence in Q1|25 to test the selected advanced target by Q2|25.

“Drill assays received to date continue to return results that align with or exceed our original estimates. It is anticipated that the drill program will positively impact the short- to medium-term production profile and economics of Bunker Hill, as presented in the 2022 Pre-Feasibility Study,” noted Sam Ash, President and CEO. “The Company is on track to complete a resource estimate update incorporating these results in the first quarter of 2025”.

“Our exploration strategy focuses on delineating resources from our large Inferred inventory in the short term while preparing for medium and longer-term exploration success by advancing exploration targets to the drill ready stage. Ongoing datamining of the extensive historical database has defined a high-grade, 5 to 10 ounces per tonne, approximately 500,000-to-1-million-ounce silver target that we are excited to test in the first quarter of 2025. If successful, this would represent a significant return on our exploration investment and aligns with our strategic objective of boosting silver production during ramp-up and commercial production while maintaining steady-state silver production of at least 700,000 oz per annum over the life of mine”.

Overview of Exploration Targets

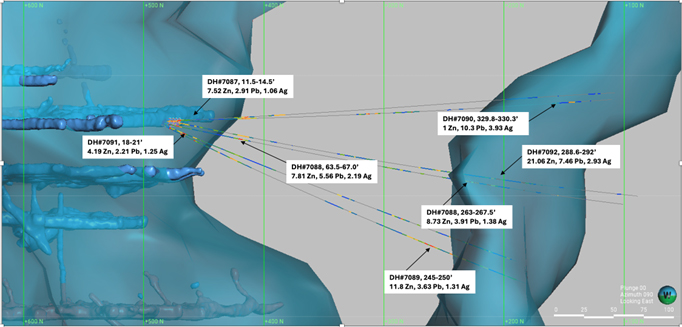

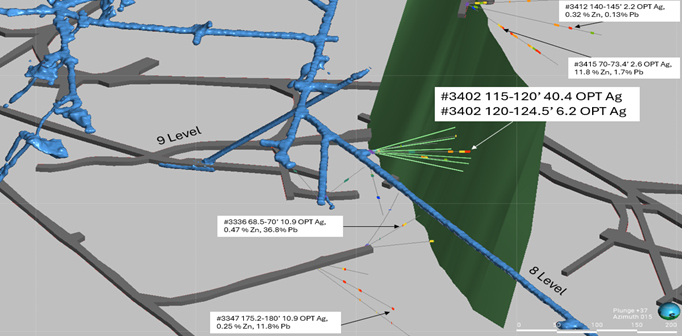

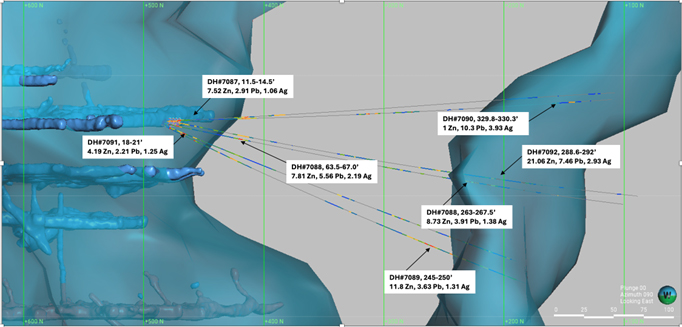

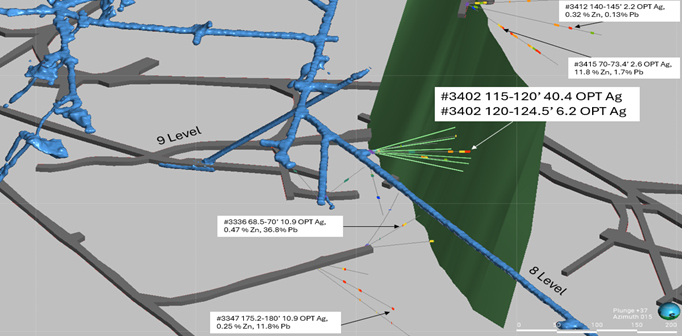

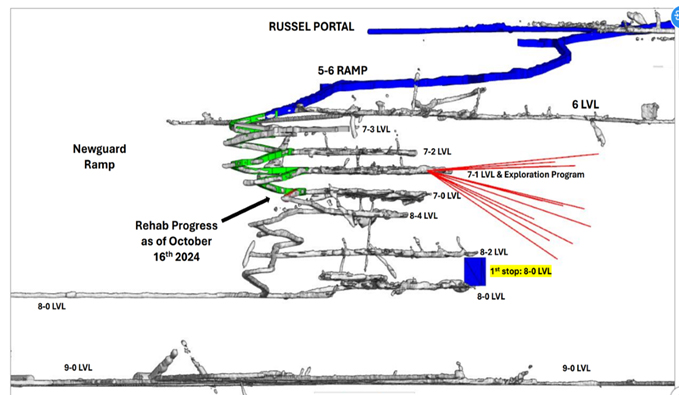

Based on the new drill data received and the available historical geological data, the number of identified exploration targets across the deposit has increased from 12 to 14, with one of the new targets outlined below. Figure 1 below highlights the current resource delineation program. Figure 2 below highlights the proposed drill plan for the high-grade silver target between the 7 and 9 Levels.

Figure 1: Map with 2024 drill results highlights (Zinc and lead percentages and silver in ounces per tonne)

Figure 2 - Drill plan for the recently defined high-grade silver target (green proposed drill holes) *

* note location of historic drill hole #3402

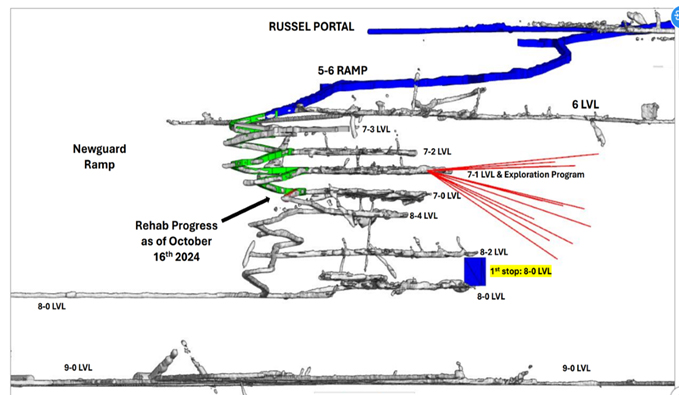

Figure 3 – Isometric view of rehab progress with first production stope identified

2024 Exploration Program

The 2024 drill campaign, which totals 19 drill holes (8,000 feet), will be completed at the end of December. It aims to confirm historical drilling and contribute to an updated NI 43-101-compliant resource and reserves statement expected to be published in Q1|25.

As detailed in Table 1 below, assays have been received for the first six holes, highlights of which include:

Table 1 - Notable intercepts from the ongoing 2024 drill campaign

| Hole ID |

From |

To |

Length (feet) |

Zn (%) |

Pb (%) |

Ag OPT |

| 7087 |

11.5 |

14.5 |

3 |

7.52 |

2.91 |

1.06 |

| 7088 |

63.5 |

67 |

3.5 |

7.81 |

5.56 |

2.19 |

| 7088 |

263 |

267.5 |

4.5 |

8.73 |

3.91 |

1.38 |

| 7089 |

245 |

250 |

5 |

11.8 |

3.63 |

1.31 |

| 7090 |

329.8 |

330.3 |

1 |

1 |

10.3 |

3.93 |

| 7091 |

18 |

21 |

3 |

4.19 |

2.21 |

1.25 |

| 7092 |

288.6 |

292 |

3.4 |

21.06 |

7.46 |

2.93 |

The full assay table is attached in Appendix 1.

An additional drill campaign, totaling 3,000 feet (~910 metres), is expected to commence in Q1|25. This program will follow up on vein-type drill intercepts centred around the historic drill hole #3402, completed before the closure of the mine in 1982 (Table 2). Early indications are this program, if successful, may significantly add to our current silver resource. This material could be available for mining in 2025.

Table 2 - Historical drill intercepts for high-grade silver target area

| Hole ID |

From |

To |

Length (feet) |

Zn (%) |

Pb (%) |

Ag OPT |

| 3402 |

115.0 |

120.0 |

5.0 |

3.2 |

0.3 |

40.4 |

| 3402 |

120.0 |

124.5 |

4.5 |

2.6 |

0.11 |

6.2 |

| 3336 |

68.5 |

70.0 |

1.5 |

0.47 |

36.8 |

10.9 |

| 3347 |

175.2 |

180.0 |

4.8 |

0.25 |

11.8 |

10.9 |

| 3412 |

140.0 |

145.0 |

5.0 |

0.32 |

0.13 |

2.2 |

| 3415 |

70.0 |

73.4 |

3.4 |

11.8 |

1.7 |

2.6 |

NEXT STEPS:

- Completion of the 2024 drill campaign, which focuses on the systematic in-fill drilling and resource conversion in the Quill Newgaurd ore body

- Updated mineral resource and reserve issued in Q1|25

- Commencement of exploration drilling in the newly identified high-grade silver target with a preliminary 3,000-foot drill campaign in early 2025

- Continue resource expansion and conversion drilling throughout 2025, focusing on resource expansion and conversion of the Quill and Newgard areas between the 6 and 10 levels

Neither TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

QA/QC

The Company has implemented QA/QC procedures, including inserting blank, duplicate, and standard samples in all sample lots sent to Silver Valley Laboratory (SVL) facilities in Kellogg, Idaho, for sample preparation and assaying. The analytical methods are microwave Digest and Inductively Coupled Plasma Optical Emission Spectrometry (ICP) and select samples will use Fire Assay with a gravimetric finish for silver.

QUALIFIED PERSON

Mr. Scott Wilson is an independent “qualified person” as defined by NI 43-101 and is acting as the qualified person for the Company. He has reviewed, verified and approved the technical information summarized in this news release, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

ABOUT BUNKER HILL MINING CORP.

Under Idaho-based leadership, Bunker Hill intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating and optimizing several mining assets into a high-value portfolio of operations initially centered in North America. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

On behalf of Bunker Hill Mining Corp.

Sam Ash

President and Chief Executive Officer

For additional information, please contact:

Brenda Dayton

Vice President, Investor Relations

T: 604.417.7952

E: brenda.dayton@bunkerhillmining.com

Cautionary Statements

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations (collectively, “forward-looking statements”). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, “plan” or variations of such words and phrases.

Forward-looking statements in this news release include, but are not limited to, statements regarding: the Company’s objectives, goals or future plans, including the restart and development of the Bunker Hill Mine; the achievement of future short-term, medium-term and long-term operational strategies; the Silver Loan; the Company receiving TSX-V approval for the issuance of the Warrants and the Warrant Shares. Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to, those risks and uncertainties identified in public filings made by Bunker Hill with the U.S. Securities and Exchange Commission (the “SEC”) and with applicable Canadian securities regulatory authorities, and the following: the Company not receiving the approval of the TSX-V for the issuance of the Warrants and the Warrant Shares; the Company’s inability to raise additional capital for project activities, including through equity financings, concentrate offtake financings or otherwise; the fluctuating price of commodities; capital market conditions; restrictions on labor and its effects on international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit, with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company’s cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; and capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such statements or information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all, including as to whether or when the Company will achieve its project finance initiatives, or as to the actual size or terms of those financing initiatives. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Readers are cautioned that the foregoing risks and uncertainties are not exhaustive. Additional information on these and other risk factors that could affect the Company’s operations or financial results are included in the Company’s annual report and may be accessed through the SEDAR+ website (www.sedarplus.ca) or EDGAR on the SEC website (www.sec.gov).

APPENDIX 1

Recently completed drill program

| Hole ID |

From |

To |

Length |

Zn% |

Pb% |

Ag opt |

| 7086 |

52.0 |

54.0 |

2 |

4.16 |

0.56 |

0.67 |

| 7087 |

2.7 |

14.5 |

11.8 |

3.83 |

1.23 |

0.44 |

| including |

6.7 |

7.5 |

0.8 |

7.25 |

2.85 |

1.03 |

| and |

11.5 |

14.5 |

3 |

7.52 |

2.91 |

1.06 |

| 7087 |

68.0 |

71.0 |

3 |

4.28 |

0.48 |

0.22 |

| 7088 |

3.5 |

4.2 |

0.7 |

14.00 |

2.12 |

0.92 |

| 7088 |

6.0 |

6.5 |

0.5 |

12.70 |

2.00 |

0.79 |

| 7088 |

10.5 |

15.5 |

5 |

3.43 |

0.71 |

0.24 |

| including |

10.5 |

13.0 |

2.5 |

4.35 |

1.08 |

0.37 |

| 7088 |

63.5 |

67.0 |

3.5 |

7.81 |

5.56 |

2.19 |

| 7088 |

253.0 |

261.0 |

8 |

3.63 |

2.18 |

0.69 |

| including |

259.0 |

261.0 |

2 |

5.64 |

5.53 |

1.77 |

| 7088 |

263.0 |

267.5 |

4.5 |

8.73 |

3.91 |

1.38 |

| including |

263.0 |

264.0 |

1 |

11.40 |

7.47 |

2.54 |

| and |

265.0 |

266.0 |

1 |

18.10 |

6.21 |

2.37 |

| 7088 |

305.0 |

306.0 |

1 |

6.20 |

0.35 |

0.14 |

| 7089 |

7.0 |

8.3 |

1.3 |

7.81 |

2.01 |

0.81 |

| 7089 |

10.0 |

10.7 |

0.7 |

8.57 |

3.62 |

1.36 |

| 7089 |

17.0 |

21.7 |

4.7 |

4.50 |

1.74 |

0.56 |

| including |

17.0 |

17.7 |

0.7 |

9.50 |

7.75 |

2.55 |

| 7089 |

29.5 |

31.0 |

1.5 |

6.15 |

4.96 |

1.88 |

| 7089 |

63.0 |

66.0 |

3 |

3.00 |

0.52 |

0.23 |

| 7089 |

240.3 |

243.0 |

2.7 |

6.20 |

1.27 |

0.45 |

| including |

240.3 |

240.8 |

0.5 |

9.61 |

2.25 |

0.79 |

| 7089 |

245.0 |

250.0 |

5 |

11.80 |

3.63 |

1.31 |

| including |

245.0 |

245.8 |

0.8 |

13.80 |

5.34 |

1.85 |

| and |

245.8 |

247.8 |

2 |

19.70 |

4.43 |

1.65 |

| 7089 |

262.5 |

266.0 |

3.5 |

3.33 |

1.14 |

0.36 |

| 7089 |

270.0 |

272.7 |

2.7 |

10.15 |

4.00 |

1.39 |

| including |

270.0 |

270.5 |

0.5 |

9.94 |

6.19 |

2.03 |

| and |

272.0 |

272.7 |

0.7 |

24.60 |

5.63 |

2.03 |

| 7090 |

2.4 |

3.5 |

1.1 |

12.80 |

3.64 |

1.46 |

| 7090 |

6.5 |

7.0 |

0.5 |

10.00 |

1.60 |

0.68 |

| 7090 |

10.0 |

13.0 |

3 |

3.52 |

1.54 |

0.56 |

| 7090 |

20.5 |

22.0 |

1.5 |

3.02 |

0.66 |

0.21 |

| 7090 |

65.5 |

73.0 |

7.5 |

3.01 |

0.66 |

0.23 |

| including |

65.5 |

66.0 |

0.5 |

6.11 |

2.86 |

0.90 |

| and |

68.5 |

69.0 |

0.5 |

4.81 |

0.59 |

0.21 |

| 7090 |

170.0 |

180.0 |

5.5 |

4.48 |

2.79 |

0.88 |

| including |

172.3 |

173.0 |

0.7 |

15.10 |

6.02 |

2.02 |

| 7090 |

208.4 |

209.0 |

0.6 |

5.62 |

8.09 |

2.27 |

| 7090 |

329.3 |

330.3 |

1 |

1.00 |

10.30 |

3.93 |

| including |

329.8 |

330.3 |

0.5 |

2.84 |

16.90 |

6.40 |

| 7090 |

340.5 |

346.3 |

2.8 |

3.18 |

0.44 |

0.16 |

| including |

340.5 |

341.0 |

0.5 |

6.67 |

2.26 |

1.46 |

| 7091 |

1.0 |

1.8 |

0.8 |

6.38 |

1.19 |

0.63 |

| 7091 |

6.2 |

7.0 |

0.8 |

17.60 |

5.98 |

2.45 |

| 7091 |

10.3 |

11.0 |

0.7 |

3.13 |

0.86 |

0.39 |

| 7091 |

18.0 |

21.0 |

3 |

9.07 |

3.40 |

1.25 |

| including |

18.0 |

20.0 |

2 |

11.30 |

3.58 |

1.29 |

| 7091 |

215.0 |

217.0 |

2 |

4.14 |

0.47 |

0.37 |

| 7091 |

261.5 |

269.0 |

7.5 |

4.19 |

2.21 |

0.56 |

| including |

265.5 |

267.0 |

1.5 |

6.17 |

1.80 |

0.49 |

| and |

267.0 |

269.0 |

2 |

5.87 |

5.93 |

1.46 |

| 7092 |

0.0 |

2.0 |

2 |

5.25 |

0.53 |

0.28 |

| 7092 |

5.5 |

9.6 |

4.1 |

5.96 |

1.42 |

0.55 |

| including |

5.5 |

6.0 |

0.5 |

17.10 |

6.25 |

2.52 |

| and |

9.0 |

9.6 |

0.6 |

11.40 |

3.62 |

1.21 |

| 7092 |

10.9 |

11.4 |

0.5 |

4.66 |

0.73 |

0.36 |

| 7092 |

15.0 |

15.5 |

0.5 |

23.10 |

1.63 |

0.61 |

| 7092 |

237.9 |

238.5 |

0.6 |

3.36 |

0.60 |

0.16 |

| 7092 |

254.5 |

256.5 |

2 |

5.56 |

0.06 |

0.09 |

|

| 7092 |

288.6 |

292.0 |

3.4 |

21.06 |

7.46 |

2.93 |

|

| 7092 |

310.0 |

313.5 |

3.5 |

6.41 |

4.10 |

1.22 |

|

| including |

312.5 |

313.5 |

1 |

11.00 |

4.51 |

1.37 |

|

- Cutoff 2% ZN

- Minimum Width 0.5 feet

- Samples are sample length and not necessarily the true width of mineralization