News Releases

Bunker Hill Outlines Progress Towards Completing the PEA for Its Rapid Restart Program

TORONTO, Jan. 26, 2021 (GLOBE NEWSWIRE) -- Bunker Hill Mining Corporation (the “Company”) (CSE: BNKR) is pleased to report continued progress towards completing its Preliminary Economic Assessment (“PEA”), aimed at assessing the potential to rapidly restart production at the historical Bunker Hill mine located in Idaho’s Silver Valley, USA.

Sam Ash, CEO of Bunker Hill Mining, stated: “We are pleased to report an update on progress towards completion of the PEA, with a number of key parameters taking shape over the last few weeks. Engineering work to date based on our existing published resource, together with recently received drill results, continues to confirm the potential to realize our goal of rapidly restarting Bunker Hill as a profitable, sustainable, long-life underground operation.”

The PEA, led by Consulting Engineers from MineTech International LLC, is being conducted in accordance with National Instrument 43-101 (“NI 43-01”) and is expected to be based on an expanded resource, compared to that published on September 28, 2020, due to further resources expected to be delineated following recently completed drilling. The PEA is expected to be published by early in the second quarter of 2021.

While engineering work, trade-off studies and economic analysis remains to be completed, the PEA is expected to contemplate a re-start with the following parameters:

Low up-front capital costs through utilization of existing infrastructure, potentially enabling a rapid production re-start

MineTech is conducting a comprehensive review of existing infrastructure in the context of preliminary engineering designs and costing for restart capital, including areas of rehabilitation, electrical infrastructure, utility reticulation, ventilation, and material haulage. In addition, a review of the existing hoisting and shaft infrastructure is underway to engineer and evaluate options to access lower areas of the mine. Preliminary results indicate the potential for low up-front capital costs underpinned by: i) minimal development and rehabilitation work required to access initial stopes; ii) utilization of existing underground and surface infrastructure; iii) no de-watering requirement to commence re-start; iv) no requirement for above-ground tailings storage capacity; and v) no requirement for purchase of mobile equipment given the use of contract mining. Lastly, opportunity exists to offset initial capital costs during the re-start period with revenue from toll mining.

Given the presence of extensive existing infrastructure, the fully permitted status of the mine, and the above approach to the re-start, a potential re-start timeframe of less than two years is currently being contemplated.

Staged approach to mining, potentially supporting a long-life operation

Mine planning is advancing within the framework of three distinct stages to exploit the majority of the resource. Stage 1 will contemplate mining to the 11 level to exploit shallow resources located above the current water table. In Stage 2, higher-grade zinc resources extending to the 16 level could be accessed either through the existing shaft system, or alternatively through the construction of a new decline. Incremental investment in capital required for Stage 2 is contemplated to be financed from cash flow generated in Stage 1. A final Stage 3 will contemplate mining to the 23 level, facilitated through either shaft or ramp access.

Underground processing and tailings deposition with potential for high recovery rates

Consistent with the Company’s objective of developing a sustainable operation with a low environmental footprint, the PEA will contemplate construction of an underground processing facility with a design capacity of approximately 1,500 tons per day. The majority of tailings generated from ore processing will be utilized for geotechnical paste back-fill, with the remaining material to be thickened and deposited in historic mine voids. As a result, the PEA will contemplate minimal surface disturbance and no requirement for above-ground tailings capacity.

Resource Development Inc. (RDI) has been engaged to design and conduct a metallurgical testing program, with assay results being incorporated into the geological and metallurgical models as received. Historical production has shown high recoverability of silver and base metals with approximately 87% silver recovery, 92% lead recovery and 93% zinc recovery. The ongoing metallurgical test program is designed to update and confirm these recoveries, and is expected to confirm extensive historical metallurgical data.

Development of a sustainable operation with minimal environmental footprint

The preservation and enhancement of the water quality of the Coeur d’Alene lake is integral to the PEA and is fundamental to Bunker Hill management’s vision and strategy. As such, the Company is pleased to report that its underground pre-treatment facility is near completion, and has demonstrated the potential for removal of more than seventy percent of metal from effluent before it leaves the mine. Implementation of a successful long-term water management strategy will be contemplated in the PEA, consistent with the Company’s ongoing achievements. In addition, as outlined, utilization of underground processing and tailings deposition further contributes to minimizing the operation’s environmental footprint and surface disturbance activities.

Potential increase in the existing resource base

The Company’s ongoing exploration program consists of 4,570 meters (15,000 feet) of diamond drilling from surface and underground focused on targets in the upper levels of the mine located in close proximity to existing infrastructure, aimed at expanding the resource base for the PEA. Drill results recently completed and highlighted below, increase the Company’s confidence in its capacity to continue to grow the resource base.

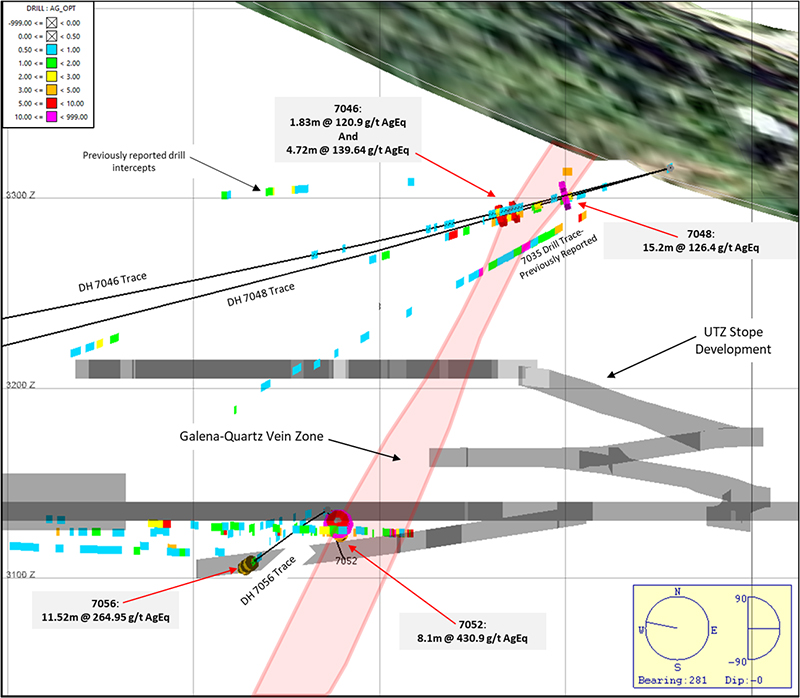

Figure 1: Silver Intercept Drilling Exploration – Cross Section

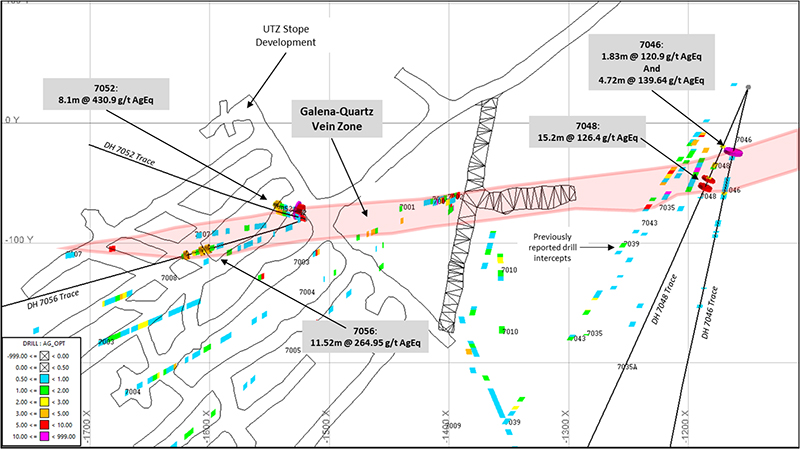

Figure 2: Silver Intercept Drilling Exploration – Plan View

Significant Silver Intercepts

| 7048 | From | To | M | AgEq g/t |

g/ton Ag | %Pb | %Zn |

| 16.8 | 32 | 12.2 | 126.4 | 41.9 | 2.21 | 0.58 | |

| Including | 16.8 | 17.4 | 0.6 | 430.2 | 91 | 4.78 | 5.61 |

| 21.9 | 23.0 | 1.1 | 276.3 | 93 | 5.07 | 1.06 | |

| 26.2 | 26.8 | 0.6 | 564.5 | 209 | 12.2 | 0.178 | |

| 28.3 | 29.3 | 0.9 | 545.1 | 215 | 11.35 | 0.148 | |

| Hole 7052 |

From | To | M | AgEq g/t |

g/ton Ag | %Pb | %Zn |

| 0 | 8.1 | 8.1 | 430.96 | 101.4 | 8.87 | 2.1 | |

| Including | 0.0 | 1.4 | 1.4 | 795.4 | 222 | 19.35 | 0.547 |

| 1.4 | 1.8 | 0.5 | 1415.6 | 391 | 33.97 | 1.46 | |

| 6.4 | 7.6 | 1.2 | 786.1 | 148 | 13.35 | 7.1 | |

| 7.6 | 8.1 | 0.5 | 379.8 | 89 | 8.87 | 1.025 | |

| Hole 7056 |

From | To | M | AgEq g/t |

g/ton Ag | %Pb | %Zn |

| 23.2 | 34.7 | 11.5 | 264.95 | 65.87 | 6.25 | 0.56 | |

| Including | 26.8 | 27.9 | 1.1 | 396.9 | 103 | 10.05 | 0.176 |

| 28.7 | 29.6 | 0.9 | 542.7 | 126 | 13.45 | 0.883 | |

| 30.8 | 31.7 | 0.9 | 405.5 | 99 | 10.1 | 0.485 | |

| 33.0 | 33.8 | 0.9 | 609.5 | 151 | 14.7 | 1.05 | |

| Hole 7046 |

From | To | M | AgEq g/t |

g/ton Ag | %Pb | %Zn |

| 28.3 | 30.1 | 1.8 | 120.9 | 42.67 | 2.23 | 0.4 | |

| Including | 28.3 | 28.9 | 0.6 | 231.4 | 86.0 | 4.55 | 0.42 |

| Hole 7046 |

From | To | M | AgEq g/t |

g/ton Ag | %Pb | %Zn |

| 35.8 | 40.5 | 4.7 | 139.6 | 19.55 | 0.77 | 2.27 | |

| Including | 36.6 | 37.5 | 0.9 | 371.4 | 25 | 0.76 | 9 |

| Hole 7046 |

From | To | M | AgEq g/t |

g/ton Ag | %Pb | %Zn |

| 53.8 | 54.3 | 0.5 | 152.1 | 23 | 1.39 | 2.48 |

(Reported widths are intercepted core lengths and not true widths, as relationships with intercepted structures and contacts vary. Prices used to calculate Ag Eq grades are as follows: Zn= $1.16/lb, Pb=$0.95/lb, Ag=$20/oz)

Technical Information

The diamond drilling program used HQ-size core. Bunker Hill followed standard QA/QC practices to ensure the integrity of the core and sample preparation through to delivery of the samples to the assay lab. The drill core was stored in a secure facility, photographed, logged and sampled based on lithologic and mineralogical interpretations. Standards of certified reference materials, field duplicates and blanks were inserted as samples shipped with the core samples to the lab.

ALS Global was used to provide analytical services and all results comply with both NI 43-101 and industry standards. ALS Global holds an industry standard ISO 17025 accreditation, specifying general requirements for laboratory performance.

The Company advises that it does not propose to base its production decision on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit. Historically, such projects have a higher risk of economic and technical failure. There is no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved. The Company further cautions that a PEA is preliminary in nature. No mining study has been completed. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that the PEA will be realized.

Qualified Person

Mr. Scott E. Wilson, CPG, President of Resource Development Associates Inc. and a consultant to the Company, is an Independent “Qualified Person” as defined by NI 43-101 and is acting at the Qualified Person for the Company. He has reviewed and approved the technical information summarized in this news release.

About Bunker Hill Mining Corp.

Bunker Hill Mining Corp. has an option to acquire 100% of all saleable assets at the Bunker Hill Mine. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR and EDGAR databases.

For additional information contact:

Sam Ash, President and Chief Executive Officer

+1 208 786 6999

sa@bunkerhillmining.com

Cautionary Statements

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations. Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s intentions regarding its objectives, goals or future plans and statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: the ability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine Complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

This press release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this press release have been disclosed in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian disclosure standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (“SEC”), and resource and reserve information contained in this press release may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for disclosure of “reserves” are also not the same as those of the SEC, and reserves disclosed by the Company in accordance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits contained in our website may not be comparable with information made public by companies that report in accordance with U.S. standards.