News Releases

Bunker Hill Places ESG and Regeneration at the Core of Its Innovative Value Creation Strategy

TORONTO, Oct. 18, 2021 (GLOBE NEWSWIRE) -- Bunker Hill Mining Corporation (the “Company”) (CSE: BNKR; OTCQB: BHLL) is pleased to introduce its innovative ESG vision, report significant progress with its ongoing sustainability and community impact programs, and looks forward to discussing these at the 6ix ESG Panel on Wednesday, October 20, 2021 at 12:00 ET. Investors and stakeholders are invited to register for this event following this LINK .

Brad Barnett, VP Sustainability of Bunker Hill Mining, stated: “The restart of Bunker Hill Mine using modern techniques will not only deliver important metals to the Green Economy and outstanding financial returns for our investors; it will also act as the catalyst for investment by our development partners into a host of other new businesses designed to multiply our long-term regenerative impacts on the local community and environment.”

As Bunker Hill refines the details of its mine restart plan, and works to conclude its on-going project finance process, the Company is partnering with carefully selected development partners, to not only improve the inherent sustainability of its mining operations, but also to enhance the local environment and economy in ways that have enduring positive impact.

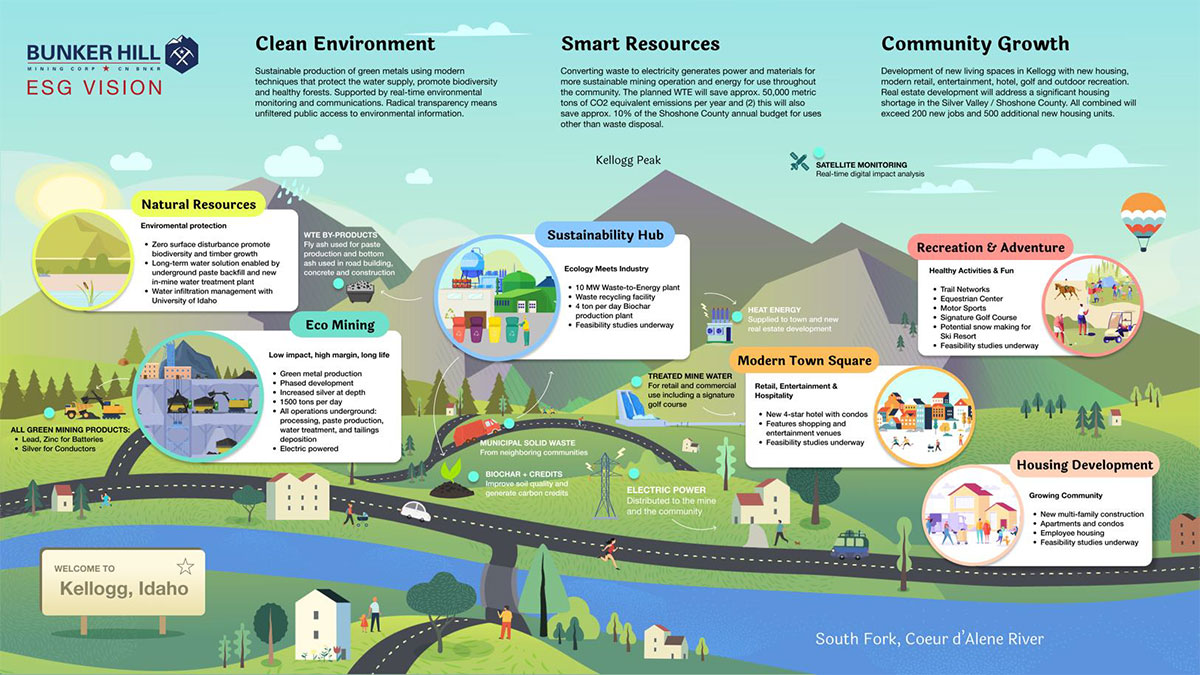

Whilst the Company’s primary focus will clearly be the restart of mining operations, its sustainability team will work with these partners to attract new impact-focused capital and expertise into an evolving ecosystem of new jointly owned, non-mining businesses created to enhance the impact of the regeneration effort initiated by the start of the mining. These are illustrated in the vision diagram above; and described in more detail below.

PARTNERSHIP PROJECT UPDATES

| (1) | Striving for ESG Excellence . In partnership with Digbee ESG , the adoption of an Industry-Standard ESG Disclosure system to drive and report world-class ESG practices within the Company. The Company has achieved a BBB rating in its first assessment with a clear roadmap for short-term actions that lead to a AAA rating. The Digbee evaluation was designed by ESG practitioners with extensive expertise in the mining industry. It provides detailed insights and incentivizes targeted actions for improvement that are specifically tailored to mining company projects and mining company management practices. |

||

| (2) | Delivering Optimal Long-Term Water Management System . Over the last 18 months, the Company’s engineers and hydrologists, working with the US EPA (Environmental Protection Agency) and the IDEQ (State of Idaho Department of Environmental Quality), have already improved the quality of the water discharged from the mine. In addition to reducing the environmental impact of the old mine site, this also reduces the burden placed upon the EPA-run Central Treatment Plant creating capacity that can be used by other mines located within the Silver Valley. |

||

| a. | New In-Mine Water Treatment Facility . In partnership with MineWater LLC , the US EPA and IDEQ, the Company has started the final engineering study for an in-mine water treatment system at Bunker Hill Mine, designed to ensure the lowest cost and most carbon-efficient, long-term water treatment solution for the mine. The system is designed to meet the Idaho Pollutant Discharge Elimination System (IPDES) limits that have been established for the South Fork of the Coeur d’Alene River. The system will separate water flows in the mine between bad quality water (highly acidic, very high dissolved metals concentrations) and better-quality water (slightly acidic, much lower metals concentrations). Bad water in the mine is very concentrated – approximately 80 percent of the metal load of the mine’s effluent is contained in only 3% of the water volume. Once isolated, the bad quality water will be mixed with a carbon-enriched lime slurry that will be settled in one area and finally polished using a Lamella Clarifier before being discharged. The better-quality water will flow from two sources. It will be pumped from the submerged workings of the mine and collected and piped from the west side of Bunker Hill mine. These will be combined into one stream that will be treated with a reverse osmosis plant. The permeate from the reverse osmosis plant will meet discharge requirements. The brine generated from the plant will be treated and converted into an alkaline sludge that will be deposited into the lower levels of the mine’s submerged working. Final engineering of the water treatment system will be completed in early 2022. MineWater LLC has designed, engineered and constructed water treatment systems at two Superfund sites in Colorado with similar water system characteristics – the Gold King and Captain Jack sites. The water treatment system at Bunker Hill will require approval by US EPA and the State of Idaho Department of Environmental Quality as a component of its water discharge permitting process, which is due to be completed by May of 2023. |

||

| b. | The advancement of a Student Educational Agreement with the University of Idaho , allows students to contribute to the design of surface capping options of exposed sections of the Guy Cave to further reduce production of Acid Mine Drainage (AMD) within the mine. Bunker Hill and the University of Idaho signed a Student Educational Agreement on August 25, 2021. This will support projects of engineering students focused on solving one of Bunker Hill Mine’s greatest environmental challenges over the coming school year. The Guy Cave area of Bunker Hill was created when a sub-level caving method of mining was planned and partially executed in 1950s. The pyrite-rich ore body in this area of the mine extends near to the surface where subsidence has occurred. The rock and soils around the surface expression of the Guy Cave are porous and highly fractured. This allows a large volume of precipitation to directly infiltrate the mine and slowly migrate through the Guy Cave sub levels where most of Bunker Hill’s Acid Mine Drainage is generated. The focus of the University of Idaho’s academic work will be to identify and engineer the best cost-benefit relationship for solutions that mitigate or eliminate infiltration of surface waters into the Guy Cave. If successful, this solution will have a significantly positive long-term impact on the environmental management of the Bunker Hill site by preventing the creation of Acid Mine Generation. When combined with the injection of paste into acid generating stopes, as Bunker Hill currently plans to do in the same area of the underground mine, the long-term closure costs will be dramatically reduced. This agreement marks the second environment-focused collaboration between the University of Idaho and Bunker Hill Mining Corporation. The first was a Sponsored Research Agreement with the Hydrogeology faculty, including Bunker Hill’s funding of research by the University’s graduate students. The research will establish several different water flow paths from surface to the main level of the mine (the 9-level) where water is discharged. The study will collect and analyze data related to the volume, direction, and velocity of flow in different paths to help inform future water management solutions. The Collaborative Research Agreement is designed as a 3-year study that was signed on May 6, 2021. |

||

| (3) | Developing Green Power Capability . In partnership with Colorado-based Ensero Solutions LLC , the start of a Waste-to-Energy Power Plant (WTE) Feasibility Study to investigate the use of Municipal Solid Waste (MSW) to generate electrical power for Bunker Hill Mine and the City of Kellogg and Shoshone County while eliminating waste disposal costs and carbon emissions for the County. WTE facilities sort waste into combustible and non-combustible streams. Combustible materials are generally incinerated to produce energy, while non-combustible materials are sent to recycling facilities. There are 76 WTE facilities in the U.S. that process nearly 94,000 tons of MSW per day producing 2.5 GW of electricity and 2.7 GW of combined heat and power ( www.erc.org ). This equates to approximately 13% of all MSW generated in the U.S. and powers 2.3 million homes. According to academic research, “every ton of waste processed at a WTE facility avoids a ton of CO 2 equivalent emissions.” 1 The study into the construction and operation of a WTE Plant near the mine site, will analyze the feasibility of using different volumes of MSW from Shoshone County and Kootenai County as feedstock. The plant could provide up to 8 MW of low-cost, green power to Bunker Hill Mine, displacing the need for the mine to draw upon the regional power grid and reduce long-term mine operating costs. If feasible, this project would be funded and operated by 3 rd party partners, with capital estimates being in the region of $25M. Permitting of the WTE facility will require Clean Air Act permitting by the US EPA. This plant would also eliminate the need to transport waste to landfills in Missoula, Montana saving taxpayers in both counties more than $2.0M in waste disposal costs, while also significantly reducing the carbon footprint associated with more than 90,000 miles of annual transport from Idaho to Montana. The ash produced by the plant would be an input for Bunker Hill’s low porosity paste plant whose product will backfill acid-generating stopes, reducing further any long-term environmental challenges within the mine. The WTE Plant, if feasible and once permitted, will use a portion of the untreated better-quality water stream in the mine. The volume of this beneficial usage of the water will be determined by the studies that are currently underway. The WTE Plant will also provide a disposal site for the sludge produced by water treatment once the submerged workings of the mine have been fully dewatered. Shoshone County currently does not have recycling capacity, but it produces approximately 3,000 tons of recyclable materials per annum from municipal waste, which places pressure on the limited landfill capacity. If the WTE facility were to include the ability to shred and sort crushed automobiles, this would increase significantly. Crushed cars are currently sent from Shoshone and Kootenai counties to a shredder in Seattle, Washington. |

||

| (4) | Developing Local Biochar Production Business . In partnership with The Future Forest Company Ltd , the start of a scoping study into the establishment of a pyrolysis plant for biochar production may be located near the WTE facility. The biochar plant will run on wood fiber waste that would otherwise be burned or deposited into landfills. The products of the pyrolysis process are biochar, which sequester significant amounts of carbon and large amounts of heat that will power a steam turbine to produce electricity. Biochar is the solid carbon-rich output from a process where biomass (forest waste and other wood fiber) is baked in a low oxygen environment. Biochar produced from pyrolysis delivers significant soil restoration and carbon storage benefits when applied to the soil. As such, it forms an important part of any regenerative agriculture strategy. It also locks carbon in ways that reduce global carbon and greenhouse gas emissions. The biochar feasibility study contemplates a scale of approximately 16 tons per day of usable wood fiber feedstock, that would produce approximately 4 tons of biochar per day. The estimated cost of the plant and facility is $3 million. Feasibility analysis will progress from a scoping study to a pre-feasibility study and ultimately progress to a full feasibility study that is expected to be completed by mid-February of 2022. |

||

| (5) | Develop Residential and Recreational Real Estate . In partnership with Edwards Group LLC , the restart of Bunker Hill Mine will add approximately 150 new fulltime jobs in Shoshone County in 2022. This will occur at a time where significant housing shortages exist in both Shoshone County and neighboring Kootenai County (which includes Coeur d’Alene, Idaho). BNKR is working with experienced land planners and real estate market advisors to determine the optimal scales of development, product mix, amenity and service offerings and product pricing for our investment partners. The Company is now in discussions with potential investment partners. Edwards Group LLC, advising on both land and product planning, was a driving force behind the development of the Deer Crest community and luxury hotel in Deer Valley, Utah. They have also developed resorts in Moab, Utah and contributed to the development of real estate projects in Jackson, Wyoming among many others in the western United States. Real estate projects under analysis include multi-family housing, single-family detached housing, mixed use real estate (including retail, entertainment and commercial), resort hotel and recreational real estate. Land acquisition and permitting activities are anticipated to begin in 2022. |

||

QUALIFIED PERSON

Mr. Scott E. Wilson, CPG, President of Resource Development Associates Inc. and a consultant to the Company, is an Independent “Qualified Person” as defined by NI 43-101 and is acting at the Qualified Person for the Company. He has reviewed and approved the technical information summarized in this news release.

UPCOMING EVENTS

6ix ESG Panel: Uplifting Local Communities in the Areas where we Operate

October 20, 2021 @12:00 ET

Join Us: REGISTER NOW

On Behalf of the Board of Bunker Hill Mining Corp.

Sam Ash

Chief Executive Officer & Director

+1 208 370 3665

For additional information, please contact: ir@bunkerhillmining.com

ABOUT BUNKER HILL MINING CORP.

Under new Idaho-based leadership the Bunker Hill Mining Corp, intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating a portfolio of North American precious-metal assets with a focus on silver. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR and EDGAR databases.

CAUTIONARY STATEMENTS

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations. Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s intentions regarding its objectives, goals or future plans and statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: the ability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company's cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments to the Lessor and the U.S. EPA pursuant to the terms of the agreement to acquire the Bunker Hill Mine Complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry; the cost, timing and ability to implement ESG initiatives which may not be technically successful or economically viable; and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

1 Brunner, P. H. and Rechberger, H. (2015) ‘Waste to energy - key element for sustainable waste management’, Waste Management. Pergamon, 37, pp. 3-12. doi: 10.1016/j. wasman.2014.02.003.