TORONTO, March 22, 2022 – Bunker Hill Mining Corp. (the “Company”) (CSE: BNKR, OTCQB: BHLL) is pleased to provide an update on its Bunker Hill Mine project, following on from its previous update in November 2021.

Sam Ash, CEO stated: “I am very pleased with the progress that the Bunker Hill team and its partners are making in finalizing the restart plan for the mine, concurrent with our on-going equity financing. We remain on track to enable a construction decision in Q2 2022.”

RESTART PROJECT UPDATE

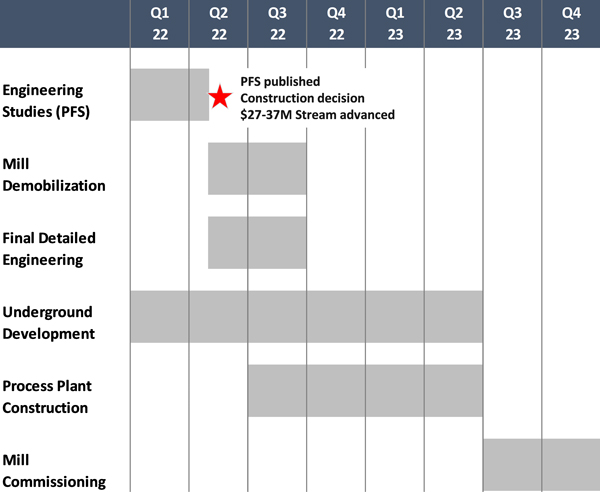

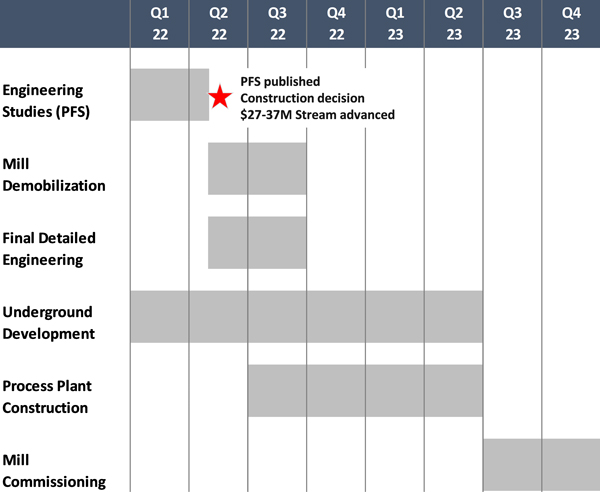

The Company continues to advance technical studies to a level that will enable a construction decision to be made and a Pre-Feasibility Study (“PFS”) to be published during Q2 2022. The PFS will focus upon mining of Measured and Indicated Resources that maximize cash flow and returns on initial capital invested, leveraging existing infrastructure and the Pend Oreille process plant once it has been relocated to the Bunker Hill site. The Company aims to have the mine in commercial production by the end of 2023, in accordance with the summary timetable shown below.

Figure 1: Bunker Hill Planned Development Timeline

The technical studies to support both a PFS and a Construction Decision remain on track, with updates to some of the key and supporting activities detailed below:

Figure 2: Technical Studies Update

| Project |

Work Currently In-Progress |

Completion %

(To PFS) |

| Process Plant Engineering |

- GA drawings for processing plant and crushing gallery complete. Multiple simulation exercises have indicated reduced initial construction capital expenditures from PEA estimates.

- Trade-off studies complete. These affirm preference for an underground location for the primary crushing circuit on Level 9, with milling and flotation circuits on surface within existing building.

- Final cost analysis, detailed construction planning and construction contractor negotiations on-going.

|

80 |

| Tailings and Backfill Plant Engineering |

- Final paste plant design and location trade-offs on-going.

- Opex trade-off analysis and mine scheduling on-going.

- Geotechnical analysis of back-fill requirements indicates significant cost savings from PEA estimates.

|

85 |

| Metallurgy |

- Metallurgical studies continue to further optimize the mill and process flow sheet used in the PEA.

- Final Lock-Cycle Testing (LCT) on-going.

|

80 |

| Geotechnical Study |

- Golder and Associates study complete, supporting geotechnical assumptions made within the PEA.

|

100 |

| Mine Planning |

- Detailed stope sequencing and optimization on-going.

- Ore haulage trade-off studies complete. Crushed ore to be moved from UG crushing gallery to surface processing circuits via conveyor within the Kellogg Tunnel.

|

85 |

| Pend Oreille Plant Demobilization |

- Project/process plant manager appointed.

- Final demobilization planning on-going, set to meet timelines agreed with Teck, with cost estimates in line with PEA.

|

85 |

| Current Mining and Rehabilitation Activities |

- CMC (mining contractor) building organic capacity on site. This includes adding local staff and acquiring mining equipment including LHDs.

- Rehabilitation of UTZ drift on 5-Level completed on schedule.

- Initiating construction of decline ramp to connect 5-Level with existing 6-level spiral ramp for rubber-tired equipment.

|

N/A |

| Bunker Hill Surface Upgrades |

- Mine yard and surface facilities now cleared to accept Pend Oreille plant equipment.

- Finalizing plans to upgrade electrical infrastructure to both Kellogg and Wardner Portal yards.

|

N/A |

FINANCING UPDATE

The private placement of Special Warrants of up to C$15,000,000, as announced in the Company’s news release dated March 9, 2022, is expected to close on or about March 30, 2022. In addition, the Company is in discussions with providers of non-dilutive financing to meet its obligations to the U.S. Environmental Protection Agency (“EPA”). These obligations, as described in the Company’s news release dated December 20, 2021, include payment of $2,900,000 of water treatment costs and securing $17,000,000 of financial assurance, which could include performance bonds or letters of credit. In consultation with the EPA, the Company has committed to meet these obligations by 180 days from the effective date of the Amended Settlement Agreement. Pending final due diligence by the Company’s financial partner (Sprott Private Resource Streaming & Royalty Corp.) and other closing conditions, the completion of engineering studies will support the advance of up to $37 million under the multi-metals Stream as announced on December 20, 2021.

QUALIFIED PERSON

Mr. Scott E. Wilson, CPG, President of Resource Development Associates Inc. and a consultant to the Company, is an independent “Qualified Person” as defined by NI 43-101 and is acting as the Qualified Person for the Company. He has reviewed and approved the technical information summarized in this news release.

The Qualified Person has verified the information disclosed herein, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

ABOUT BUNKER HILL MINING CORP.

Under new Idaho-based leadership the Bunker Hill Mining Corp, intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating a portfolio of North American mining assets with a focus on silver. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR and EDGAR databases.

For additional information contact:

David Wiens, CFA

CFO & Corporate Secretary

+1 208 370 3665

ir@bunkerhillmining.com

Cautionary Statements

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations. Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information.

Forward looking information in this news release includes, but is not limited to, the Company’s intentions regarding its objectives, goals or future plans and statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: the ability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company's cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine Complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

This press release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this press release have been disclosed in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian disclosure standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (“SEC”), and resource and reserve information contained in this press release may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for disclosure of “reserves” are also not the same as those of the SEC, and reserves disclosed by the Company in accordance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits contained in our website may not be comparable with information made public by companies that report in accordance with U.S. standards.