Live 6ix Summit Tuesday December 6 @ 2:00pm ET / 11:00am PT

HIGHLIGHTS

- Abatement of maintenance shop complete, demolition to prepare for new mill building underway

- Commitment made to new Bunker Hill pre-engineered mill building design and vendor

- Underground decline advances to within 300 feet of breakthrough to 6-Level

- Preparation for Wardner Power upgrade advanced with pole locations surveyed, cable corridor cleared, transformers set and air switch and electrical ancillaries received on site

- CEO Sam Ash and CFO David Wiens to host interactive 6ix investor event, Tuesday December 6 at 2:00pm ET / 11:00am PT. Investors are invited to register at: [LINK]

TORONTO, December 1, 2022 – Bunker Hill Mining Corp. (the “Company”) (CSE: BNKR, OTCQB: BHLL) is pleased to provide an update on restart project activities during the month of November 2022.

Sam Ash, CEO stated: “With the Pend Oreille demobilization complete, our full focus in November was at Bunker Hill, with excellent progress made above and below ground. We are excited about declaring three major milestones in the near future: full demolition of the maintenance shop in preparation for mill construction, the safe and successful breakthrough to the 6-Level, and the purchase of the ball mill that is capable of increasing production throughput levels to 2,100 tons per day, subject to future detailed mine planning and engineering.”

DEMOLITION ACTIVITIES IN PREPARATION FOR MILL CONSTRUCTION

After successful demolition activities at Pend Oreille, the team’s focus switched to preparation for the demolition of the maintenance shop on site at Bunker Hill. As reported in the Company’s news release of November 3, 2022, the Company selected Rivers Edge Environmental Services, a fully licensed remediation, excavation and demolition company headquartered in Washington State, USA for this work. Activity in November began with the abatement phase that included removal, after necessary permits were first procured, of the roofing and side shingles of the structure, in accordance with hazardous assessment protocols. After successful completion of this work the windows were removed from the structure, allowing general demolition to commence at the end of November. Full building demolition is expected by the end of 2022. Thereafter, focus will switch to removal of the historic concrete base in preparation for more substantial foundations to support mill construction. The full demolition scope also includes removal of a pre-existing retaining wall and some earthworks.

Demolition of the maintenance shop in preparation for mill construction is now fully underway

COMMITMENT TO NEW BUNKER HILL MILL BUILDING AND FINALIZATION OF DESIGN

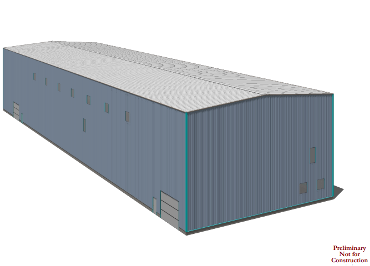

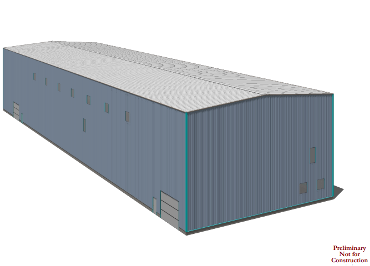

After evaluating multiple options, the Bunker Hill team has committed to a final design for a Pre-Engineered Metal Building (the “PEMB”) to house the mill, once constructed. The design is bespoke for the finalized equipment arrangement, is fully compliant with all building and environmental codes and regulations, and will house a full-length overhead crane that is compatible with planned equipment mezzanine levels. The timing of the commitment aligns fully with the planned project restart timeline and represents a key long-lead item.

Concurrent with the PEMB focus, the project team has significantly advanced engineering on a concentrate load-out building, has selected a vendor for the ore silo structure, and has progressed conveyor and crusher designs.

Bunker Hill has committed to its PEMB of choice

UNDERGROUND DEVELOPMENT NEARING BREAKTHROUGH TO 6 LEVEL

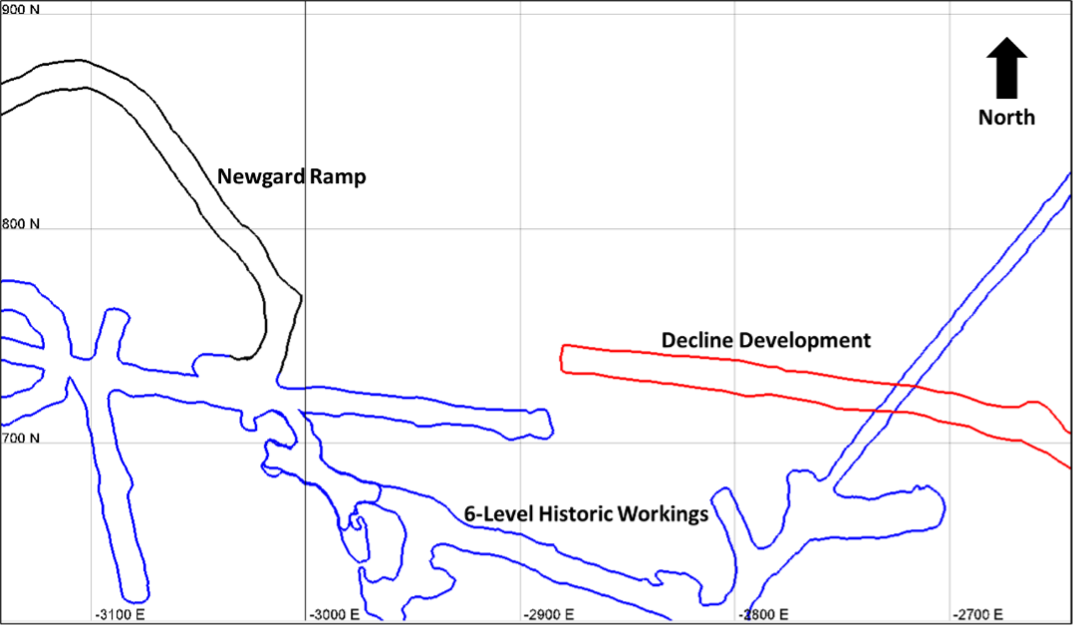

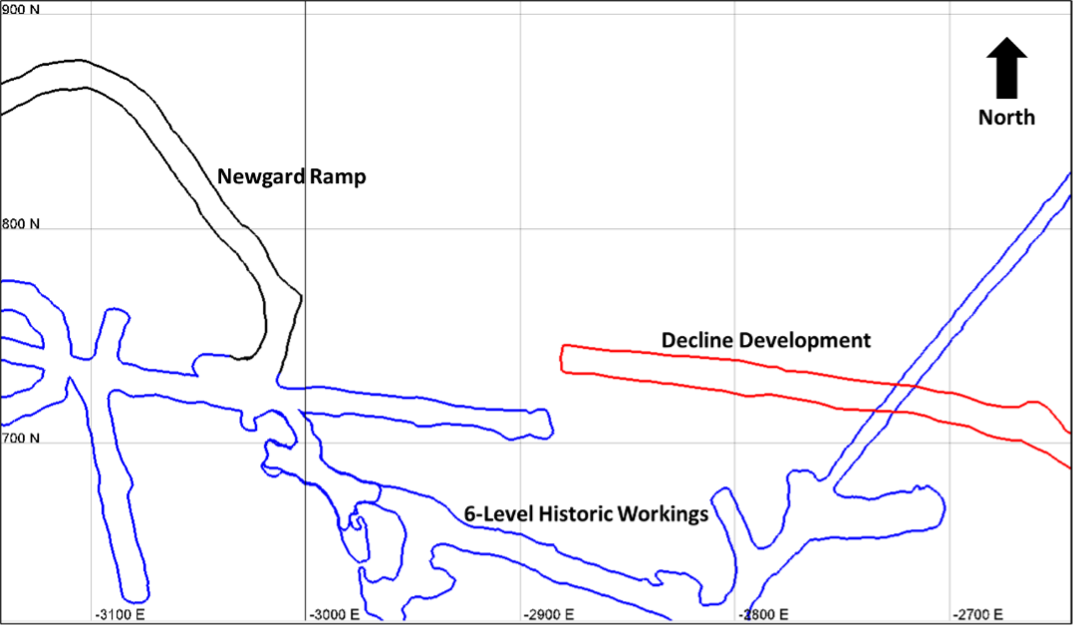

As part of the restart plan the 1,800-foot decline from the 5-Level (the highest accessible level of the mine) to the 6-Level is nearing completion, with less than 300 feet remaining. Breakthrough is anticipated at approximately the end of 2022, at which point the focus of underground activities will switch to rehabilitation of the pre-existing decline from the 6-Level to the 8-Level. During November, the ventilation drift adjoining this decline was advanced to support the long-term ventilation plan and adjustments were made to the existing ventilation plan to ensure optimal conditions are maintained through to breakthrough.

The decline from 5 Level to 6 Level has less than 300 feet remaining

WARDNER POWER UPGRADE

At the Wardner area, which serves as the above-ground base for mining operations, ongoing activities include preparation for a significant power upgrade which will reduce dependence on diesel generators and enable access to lower-cost, reliable green power. During the course of November, activities included clearing a corridor across the Bunker Hill property for cables, setting a transformer, surveying pole locations and inspecting and auditing equipment that arrived on site including the air switch and pole ancillaries. The power upgrade will include support from Avista to upgrade the external supply capacity and is planned for completion in early 2023.

QUALIFIED PERSON

Mr. Scott E. Wilson, CPG, President of RDA and a consultant to the Company, is an independent “qualified person” as defined by Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects and is acting as the qualified person for the Company. He has reviewed and approved the technical information summarized in this news release.

ABOUT BUNKER HILL MINING CORP.

Under new Idaho-based leadership the Bunker Hill Mining Corp, intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating a portfolio of North American mining assets with a focus on silver. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR and EDGAR databases.

For additional information contact:

David Wiens, CFA

CFO & Corporate Secretary

+1 208 370 3665

ir@bunkerhillmining.com

Cautionary Statements

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations. Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information.

Forward looking information in this news release includes, but is not limited to, the Company’s intentions regarding its objectives, goals or future plans and statements, the envisaged outcomes from the PFS, the capabilities of the ball mill, estimated completion time for the demolition of the Pend Oreille site, the timing of the planned restart of the Bunker Hill Mine, Strike’s ability to refine the master schedule for the project and drive engineering and other studies, the decline of the ramp at the Bunker Hill Mine’s facilitation of access to existing internal ramp systems and the accretive opportunities identified in the PFS. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: the Company’s inability to raise capital, including completion of the proposed public offering as publicly disclosed on November 22, 2022; the ability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labor and international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company's cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine Complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR, including the Company’s preliminary prospectus dated November 21, 2022, and in the Company’s filings with the Securities and Exchange Commission. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.