Annual ESG Developer/Explorer of the Year Award

- The Mines and Money ‘Resourcing Tomorrow’ Conference was held in London from 27-30 Nov 2023; Europe’s largest Mining, Energy and Resources Event dedicated to Global Sustainability Goals.

- The Award is judged on how well a Developer/Explorer has developed a long-term ESG Strategy.

- An effective ESG strategy is critical to enabling the restart of sustainable, profitable, and long-term mining operations within the Bunker Hill Superfund Site after 40 years of closure and rehabilitation.

Advancing on Plan and Budget Towards a North American ESG Milestone

- The sustainable restart of the Bunker Hill Mine is expected to be the first restart of mining operations within a Superfund Site since the start of that nationwide rehabilitation and clean-up program in 1969.

- Making use of rehabilitated infrastructure, the recycling of used mining equipment, existing permits, Idaho talent, local partnerships, and modern techniques/technology, the restart project advances on-time and on-budget; and is expected to offer between 230-250 new, modern, and long-term mining jobs to a local community hit hard by its closure in 1981.

|

Toronto, Ontario (December 14, 2023) – Bunker Hill Mining Corp., (TSX-V: BNKR) (OTCQB: BHHL) (“Bunker Hill” or the “Company”) is pleased to announce that it was awarded the ESG Developer/Explorer of the Year Award at Mines and Money’s ‘Resourcing Tomorrow’ Investment Conference in London on 30 Nov 2023.

“This special award not only recognizes the careful, thoughtful and imaginative work done by the whole Bunker Hill Team,” said Sam Ash, Bunker Hill’s CEO, “but also the awesome responsibility that is bestowed on all involved in the careful business of regenerating old mine sites to help de-risk the American critical metals supply chain”.

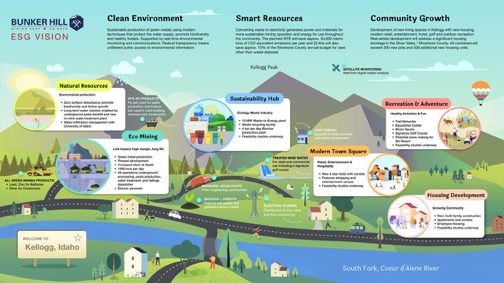

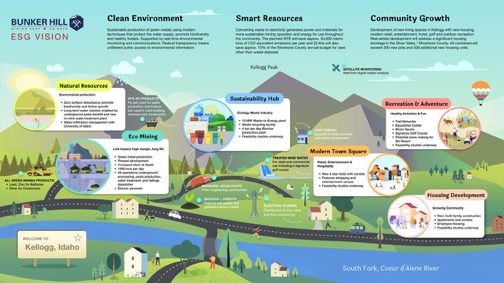

BUNKER HILL ESG AND SUSTAINABILITY VISION

Inspired by those that deliver, promote, and educate industry best practice, the Company is expecting to restart safe, sustainable, and profitable mining at Bunker Hill in ways that enhance the quality of the environment during and after the conduct of active operations.

Working as one team, the Company seeks to balance the relentless but safe pursuit of the highest long-term financial returns from investment in mining operations with a deep-rooted commitment to delivering a positive legacy.

Working with our many partners and the applicable regulators, this not only involves responsible stewardship of every aspect of the physical environment, the forward-looking development of our diverse human resources, but also a deliberate effort to deliver positive and self-sustaining socio-economic impact to the local community.

THE ESG AWARD

|

|

| Executive Chairman Richard Williams and Caroline Donnally of Sprott Streaming and Resources Business receiving the ESG Developer/Explorer of the Year Award at the Conference Dinner in London, UK. |

Bunker Hill’s General Manager Tom Francis, Environmental Manager Morgan Hill and Survey Technician Karen Ryan holding the award next to the water discharge monitoring station in the Kellogg Tunnel entrance. |

The ESG award (a replica of a 19th Century Welsh Coal Mining Lamp) sits in the office of Morgan Hill, Bunker’s site-based Environment Manager and Women in Mining (USA) Rep. - a proud former graduate of Wallace High School and the University of Idaho (B.S Chemistry). She is also a granddaughter of a former Bunker Hill miner.

THE ESG-FOCUSED BUNKER HILL FUTURE – IT’S ABOUT MUCH MORE THAN MINING

The Company has developed a number of plans (illustrated above) expected to enable both the optimal sustainability but also the maximum positive impact in the community over the long term. These will each be further developed and executed in a prioritized sequence after mining operations have been restarted; and funded via the selective reinvestment of operating cash flow and 3rd party partnership funding/support.

As with mining operations, so it will be with impact and sustainability projects, the Company will start small and then expand over time. This will be a transformational journey conducted at a sustainable and affordable pace.

QUALIFIED PERSON

Mr. Scott E. Wilson, CPG, President of RDA, and a consultant to the Company, is an independent “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and is acting as the qualified person for the Company. He has reviewed and approved the technical information summarized in this news release.

The Qualified Person has verified the information disclosed herein, including the sampling, preparation, security, and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

ABOUT BUNKER HILL MINING CORP.

Under new Idaho-based leadership, Bunker Hill Mining Corp. intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating a portfolio of North American mining assets with a focus on silver and critical metals. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

For additional information contact:

Corporate Secretary

+1 208 370 3665

ir@bunkerhillmining.com

Cautionary Statements

The TSX Venture Exchange (the “TSX-V”) has neither approved nor disapproved the contents of this news release. Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations (collectively, “forward-looking statements”). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan” or variations of such words and phrases. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties, and other factors involved with forward-looking statements could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements.

Forward looking statements in this news release includes, but are not limited to: the Company’s intentions regarding its objectives, goals or future plans and statements, including the restart of the Bunker Hill Mine and the timing, budget, profitability and long-term sustainability of mining operations; operational objectives associated with the expected restart of active mining operations, including local, socio-economic and environmental benefits, and the Company developing and executing further development plans; revenue potential opportunities from mining and the sale of ore; increases in cash flow; and the Company’s seeking other value-creating opportunities to restart mining operations at the Bunker Hill Mine, including third-party partnerships and funding. Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to: the Company’s ability to raise sufficient capital on acceptable terms for the restart and develop the Bunker Hill Mine or to fund ongoing operations; capital market conditions, restriction on labor and international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company's cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine Complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR+. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this news release have been disclosed in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The terms “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the CIM standards. Pursuant to subpart 1300 of Regulation S-K (“S-K 1300”), the U.S. Securities and Exchange Commission (the “SEC”) now recognizes estimates of “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources.” In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be substantially similar to the corresponding standards of the CIM. Investors are cautioned that while terms are substantially similar to CIM standards, there are differences in the definitions and standards under S-K 1300 and the CIM standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven reserves,” “probable reserves,” “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources” under NI 43-101 will be the same as the reserve or resource estimates prepared under the standards adopted under S-K 1300. Investors are also cautioned that while the SEC now recognizes “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources,” investors should not assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Mineralization described using these terms has a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “measured mineral resource,” “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, information concerning mineral deposits contained in this news release may not be comparable with information made public by companies that report in accordance with U.S. standards.